El Salvador’s Hilton Hotel Ventures into Tokenised Debt on BTC

A minimum $1,000 investment will need to be made by investors to purchase the token, which will be issued on the BTC layer 2 network.

At times when the global economy is shaky and the future strength of national currencies is unknown, investors often look to broaden their portfolios, scoping out alternate assets. This begs the question of which asset will stand the test of uncertain times and which would be most worthwhile investing in.

Beyond venture capital, equity and property, commodities and cryptocurrencies are popular asset classes which investors look towards. Bitcoin and gold, specifically are most commonly associated with current investment opportunities worthwhile considering. Bitcoin, which has been likened to an electronic version of the precious metal, stands as the new kid on the investment block.

Bitcoin has been referred to as the “digital gold” by professional investors, casual traders, and crypto enthusiasts. This comparison is born from several similarities that the assets share. Both gold and Bitcoin are different from national (or fiat) currencies in that they are limited in their supply and will run out. While gold, underground and a physical asset, is difficult to know the exact quantity remaining, we know that Bitcoin is capped to a maximum supply of 21 million. Once that is reached, we know that no more Bitcoin will be mined.

While they are similar in ways, Bitcoin and gold have several glaring differences which often divide investors between the two assets.

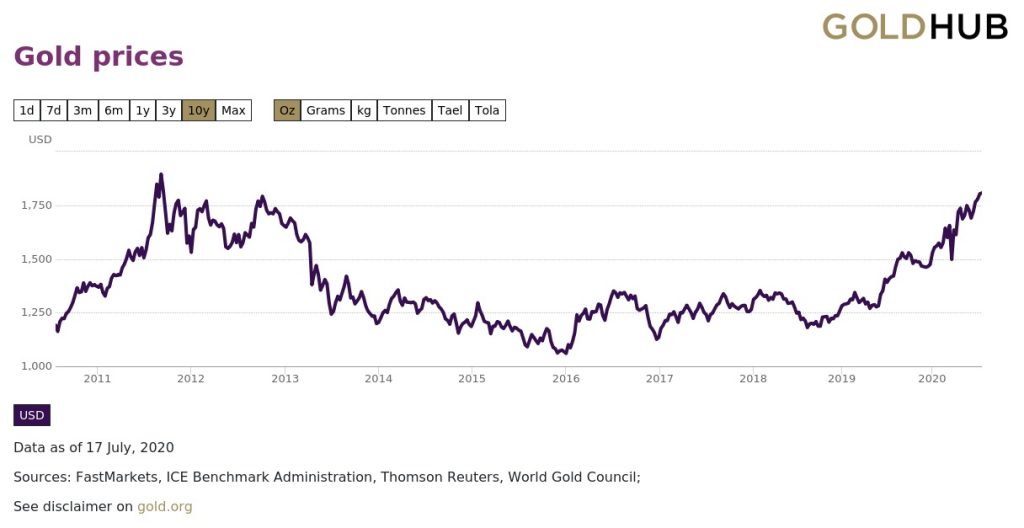

Over the past ten years, the precious metal market has held well overall, with a dip around 2013, to recover with an increase over the past few years. Now, the asset is looking at staggering values, nearing an all-time-high despite the previous decline and the global pandemic. At the time of writing, gold is holding a price tag of $1817.30 USD per ounce, which is a 7% increase in daily trading value.

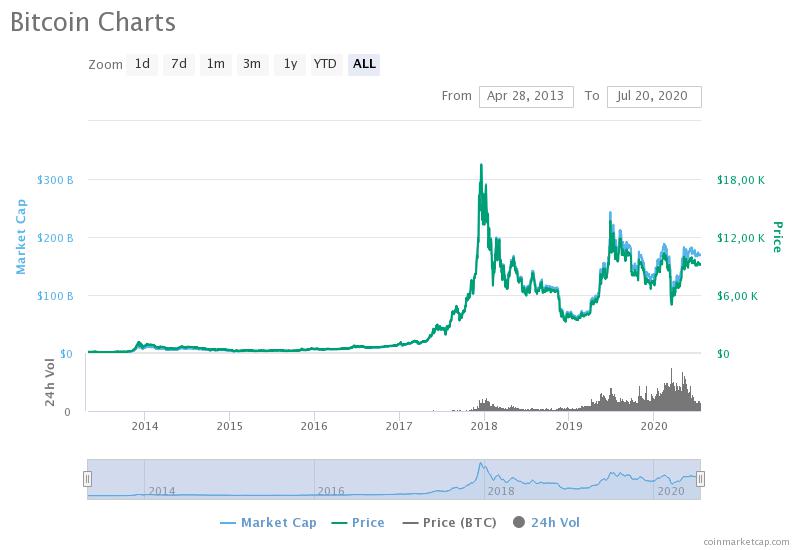

Bitcoin, as a younger asset, has had a far more volatile decade than gold. Since 2013, the cryptocurrency has seen massive increases and bearish declines, followed by surging recoveries. At the end of 2017, Bitcoin hit its highest peak to date, soaring to hold a value of $20 089,00 USD. At present, Bitcoin is valued at $9 174,59 USD per Bitcoin token, which is a 0.38% increase in daily trading values. Despite its characteristic volatility, Bitcoin has held a stable price over the past month sitting between $8 900 USD and $9 680,37 USD.

When it comes to investment, the two assets speak to different opportunities. Bitcoin’s volatility offers greater risk, but it also allows for the potential of greater reward. It also has the benefit over the gold of having a known supply quantity, meaning it can never risk overproduction. This means that the limited supply could well lend itself to strong demand as the limit of the cryptocurrency continues to draw nearer.

Gold stands as a strong hedge against market volatility and this is likely not going to change. This is especially true at the moment, given both the concerns around national economies and the currency positive trajectory of gold.

Whether you should opt to invest in Bitcoin or gold now depends on your risk appetite. If you are looking for a safe-haven without facing a high risk-reward, putting more funds towards gold might be your best bet. But if we are gearing towards a future where Bitcoin might explode again, then investing in the cryptocurrency market isn’t a bad idea.

If it’s possible, the ideal scenrio would be to ensure your portfolio is secure and diverse and consider adding both cryptocurrency and commodities to your assets.

A minimum $1,000 investment will need to be made by investors to purchase the token, which will be issued on the BTC layer 2 network.

Bitcoin mining difficulty and hash rate continue to increase ahead of the halving, a significant event expected to occur in eight days.

According to reports, the Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

Monero users' balances on Kraken after the deadline will have their coins automatically converted into Bitcoin.