El Salvador’s Hilton Hotel Ventures into Tokenised Debt on BTC

A minimum $1,000 investment will need to be made by investors to purchase the token, which will be issued on the BTC layer 2 network.

[bsa_pro_ad_space id=3]

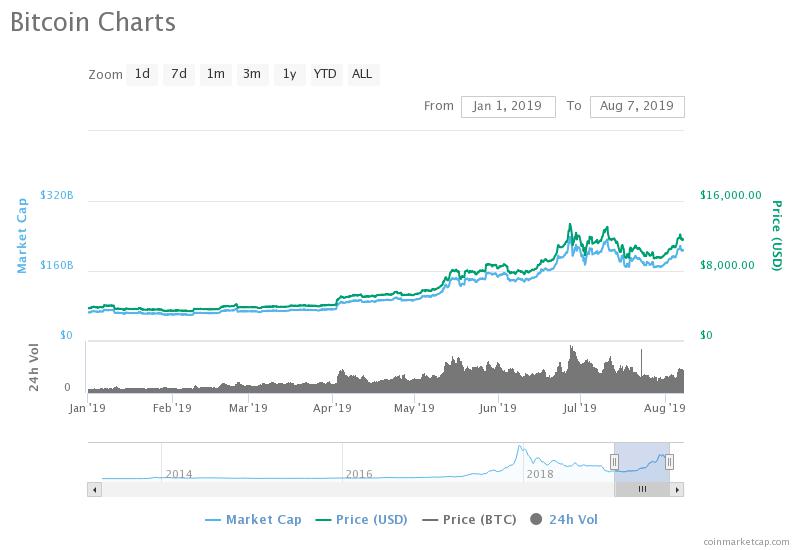

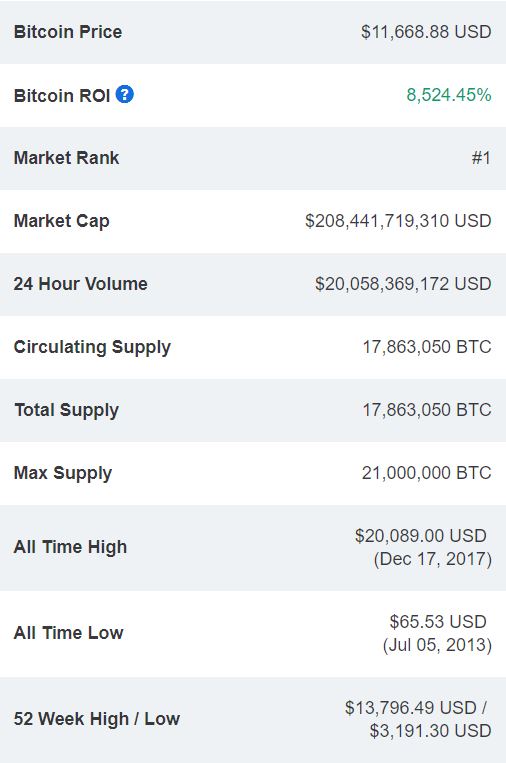

The crypto winter seems to be finally over, with Bitcoin breaking past $12,600 recently. According to CoinMarketCap, Bitcoin hit a low of $3191.30 at the end of 2018 after reaching an all-time high of close to $20,000 in December 2017. This year alone Bitcoin has increased in value from around $3400 in January 2019 to hovering around $11,600 in August at the time of writing.

Since the time of launch in 2009 Bitcoin has had a 8,524% ROI according to CoinMarketCap.

The bitcoin halving is when the reward for mining bitcoin will be halved. Currently, the reward for bitcoin miners is 12.5 BTC per block. At the next Bitcoin halving, this figure will be reduced to 6.25 BTC, this is estimated to be in May of 2020. The previous bitcoin halving was on the 9th of July 2016 when the bitcoin block reward was reduced from 25 BTC to 12.5 BTC.

The Bitcoin halving increases the scarcity of Bitcoin as the number of Bitcoin mined per block is less. The more scarce the original crypto is the greater the demand will be, which will likely lead to a price increase. History tells us that approximately 12 months away from a bitcoin halving event, we can expect a lot of price volatility leading up to the event.

The crypto winter is finally over, this also means crypto experts have started making bold Bitcoin price predictions. Here are some of the top predictions from crypto experts:

UPDATE

Coindirect.com offers a global platform to purchase Bitcoin using credit cards, crypto, bank transfers and other localised payment methods.

A minimum $1,000 investment will need to be made by investors to purchase the token, which will be issued on the BTC layer 2 network.

Bitcoin mining difficulty and hash rate continue to increase ahead of the halving, a significant event expected to occur in eight days.

According to reports, the Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

Monero users' balances on Kraken after the deadline will have their coins automatically converted into Bitcoin.