Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

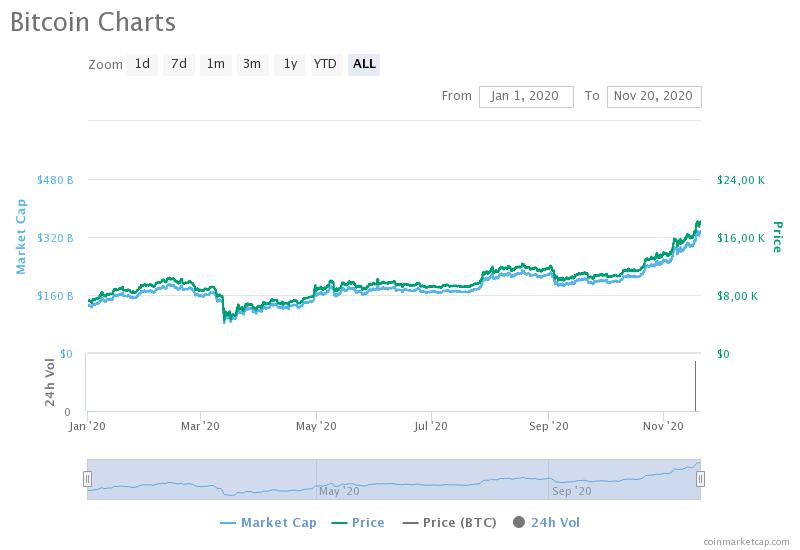

Since May 2020, Bitcoin price has seen some bullish increases, boasting double the price now than it did in the first half of the year. Looking at the price before the halving in May, Bitcoin price has gained over 110% – offering a possible bull rally tending towards the end of the year.

Over the year, Bitcoin has mostly enjoyed healthy growth, despite a bit of a dip in March. In January, the cryptocurrency was holding a value of $7,200 USD before falling to around $5,200 USD in March. In May, Bitcoin saw a recovery and was looking at just above $8,500 USD and since then the token has seen a steady rise to knock on the door of $18,000 USD at present.

According to a report by Chainalysis, a lot of the surge could be attributed to the halving given the timing and the levels of liquidity in the market. As reported by the analytics firm, the price of Bitcoin is increasing, simply put, because of increased demand and limited supply (which is more difficult to increase as a result of the halved reward for mining the token).

“Bitcoin’s price is rising because demand for Bitcoin is increasing at a time when there’s relatively few Bitcoin available to buy. While the total supply of Bitcoin grows every day as more is mined, the actual amount available to buy depends on whether holders want to sell or trade it.”

As Chainalysis pointed out, one of the biggest differences between this bullrun and the major rally in 2017 is linked to who is buying Bitcoin. In 2017, the main demand of the Bitcoin came from individuals or retail investors looking to buy and make a profit using their own capital and personal funds. In addition, the investors were ranging from experienced traders to those with little to no cryptocurrency insight.

Now, however, there has been a massive shift to institutional investors looking to buy Bitcoin to hedge against the dollar. With a massive increase in purchasing from firms like Grayscale and Square, the demand for Bitcoin has increased dramatically. As a positive for the price of Bitcoin, the institutional investors don’t seem to be slowing down in how much cryptocurrency they are buying.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.