Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

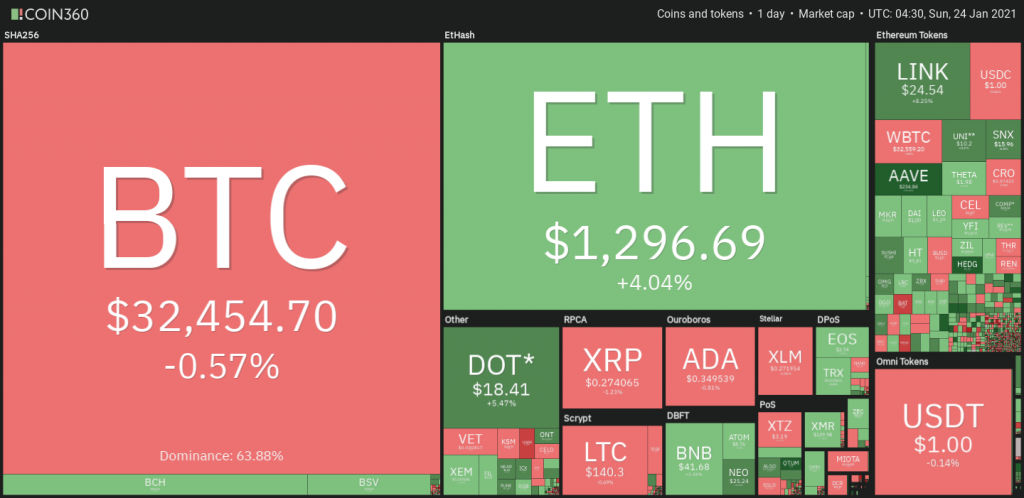

While Bitcoin might have tumbled below $30,000 USD from a record high of nearly $42,000 USD, the leading cryptocurrency has managed to find its way back up to just over $32,000 USD as MicroStrategy and retail traders took the opportunity to buy the dip.

Despite the quick surge, Bitcoin investors are still cautious after the price dropped so significantly as the cryptocurrency continues to trade sideways. At the time of writing, Bitcoin price is sitting at $32,453.64 USD according to CoinMarketCap, which is very slightly in the red with a less than 1% dip in daily trading. Over the past week, however, Bitcoin has dropped by 10.27% of what it was boasting. Analysts believe this is a short-term correction and the cryptocurrency will increase once more with more sustainable health.

Looking at the data across the market, the cryptocurrency industry is green and red all over, with altcoins either influenced by dominant Bitcoin and trading below their trading value over the past 24% hours or enjoying increased prices.

The leading altcoin is currently sitting at a 5.31% price increase over the past day’s trading. Over the past 24 hours, Ethereum price has seen a low value of $1,200.89 USD compared to its high trading value of $1,301.70 USD. While Bitcoin took a dip to fall far from its record high recently hit, Ethereum price is still in the range of its all-time high of $1,432.30 USD. While the market remains uncertain about what the market might do in the short-term, Ethereum could well see an increase despite Bitcoin’s bearish outlook.

Currently, the top five altcoins boasting the biggest rally in the market over the past day are all outside of the top ten cryptocurrencies Qtum is leading at the time of writing, with a 32.15% increase in daily trading. Aave is sitting at 22.77% gained and Band Protocol is looking at a 17.03% increase over the past 24 hours.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.