Top Five Crypto Red Flags on Social Media

Some scams are easy to see, but others might look like a worthwhile investment opportunity. Here are some crypto red flags to look out for.

In cryptocurrency, any alternative digital currency in the market is referred to as an altcoin. The term can be broken down into “alternative” and “coin” and their functions can be similar to or completely different from the original cryptocurrency.

Tokens based on the blockchain exist to serve different purposes. Some are money, some offer a function for application, and others are a way to pave the way to implement the concept of digital currency into the traditional finance system. In this, we’re looking at the four different kinds of altcoins and what they do in the world of crypto.

Protocol coins are cryptocurrencies that are created to act like money. Bitcoin is an example of a protocol, and so is Monero and Litecoin (which is based on Bitcoin’s original blockchain). Protocol coins are designed to offer:

Typically, protocol coins that are anonymous and untraceable are in the process of government regulation across the world. Some countries have outright banned cryptocurrencies based on how protocol coins might be used illicitly and for fraud or terrorism because the funds can’t be traced to an individual person. Other countries are looking to regulate and implement a responsible way for citizens to use and store Bitcoin and other cryptos. Some countries are pro-crypto and have adopted a stance that encourages users and traders to look to digital currency for long-term investment. El Salvador was the first country, and is currently the only country, to have adopted Bitcoin as legal tender in the country and the government has set to buying Bitcoin throughout the year.

Utility tokens provide users with a product or service and act as an access point into a network. Without owning the token, you can’t access the services a blockchain or platform might offer. A utility token is issued by the network to fund the development of the network and can then by used by the holder or user to access what the platform offers. Chiliz ($CHZ) is an example of a utility tokens that allows users to take part in the Socios network – a platform built for sports fans to buy and trade collectable digital tokens.

One of the most popular utility tokens we’ll see is the ERC-20 standard. Ethereum is a proton token itself, but the blockchain offers a platform for other networks to build on it (known as an application layer) through smart contracts. For other networks to build on Ethereum, they rely on ERC-20 to do this.

Stablecoins are the holy grail between cryptocurrency and traditional finance. These are tokens which are pegged at a one to one ratio to an underlying, pre-existing currency. Typically, stablecoins are pegged to a fiat currency like the US dollar. The blockchain-based stable currencies are built to offer a way for users to enjoy the properties of cryptocurrency without suffering from the volatility that crypto has experienced.

Coinbase’s USDC and Tether are examples of stablecoins but there are many more. Stablecoins can be broken down into three different types:

Central Bank Digital Currencies, also known as CBDS, are cryptocurrency coins that are directly issued from a government or central bank, Unlike stablecoins, which are decentralised from governments, CBDCs are created by a national bank with the purpose of introducing blockchain to the financial system without the unregulated nature of cryptocurrency as we know it.

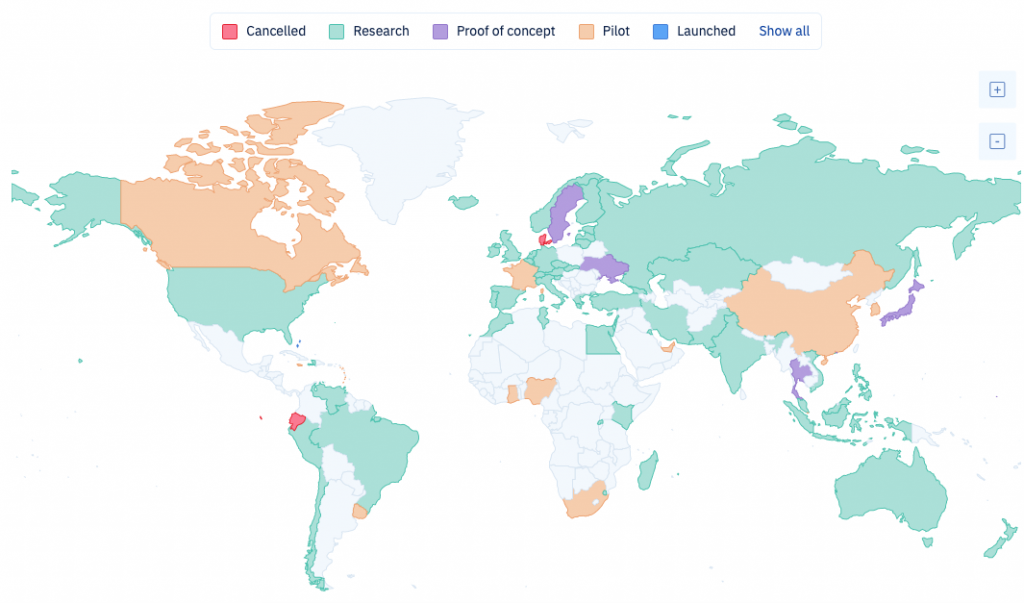

There has been a massive rise in governments and banks exploring CBDCs, with over 50% of countries across the world testing digital currencies. Right now, there is one country that has officially launched and is using a CBDC backed by the state. In 2002, the Sand Dollar was launched by the Central Bank of the Bahamas and works in conjunction with the Bahamian dollar.

Source: CBDC Tracker

There is a different kind of token that lives in the world of cryptocurrency but doesn’t quite work in the same way as the other cryptocurrencies. Non-fungible tokens (or NFTs) are cryptocurrencies that have unique individual values according to the asset. With other cryptocurrencies, each token is the exact same as the other (one Bitcoin equals another Bitcoin), but with NFTs, every token has a different value and represents a different asset. NFTs used for digital assets like art, music, collectables and much more.

Because of the blockchain-based design, NFTs are great to provide authentic, immutable digital ownership which can be used across all scopes of the online world. It means you can buy an artwork that has been created digitally and know that you have complete ownership of that original piece and that no-one can take that from you (even if it’s screenshot or copied) because of the blockchain record, which cannot be altered without verification. NFTs also offer a way for people to have a record of documents that cannot be modified, such as using a NFT to store their driver’s license, university diploma, or property.

If you were to buy shares in a company, you would probably look at what the company offers before funding it. In the same way, if you’re looking to invest in a cryptocurrency, it’s a good idea to get to know the project behind the token to see long-term use-cases, functionality to come to some sort of understanding of the possible future of the cryptocurrency.

The world of blockchain is growing exponentially, and we’ll likely be seeing countries implementing cryptocurrencies in some capacity or other into the traditional financial system. Getting to know the industry a little before this will go a long way in understanding the benefits and the possible pitfalls of the industry as it reaches more mainstream mass adoption.

Some scams are easy to see, but others might look like a worthwhile investment opportunity. Here are some crypto red flags to look out for.

Find out the countries where you'll pay the most tax if you're trading, holding, buying or selling cryptocurrencies.

Advancements in artificial intelligence and communication technologies make it difficult to discern what's real and what's a scam.

After Kate Middleton's alleged data incident and possible internal attack at the London Clinic, there's a clear need for security in cyber...