Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

As investors are adding cryptocurrencies to their portfolios and collectors are increasingly buying NFTs to store as digital assets, we’re seeing massive moves to a more digital world to work hand-in-hand with traditional means. Traditional finance is no different, and we’re seeing more countries look to add digital currencies to operate along with their national currencies in place. There has been a steady increase of central bank digital currencies (CBDCs) across the world as the national banks and governments in countries across the globe are piloting, testing and exploring the introduction of national digital currencies.

A CBDC is digital money that has been issued by a central bank in a country. They are similar to cryptocurrencies, based on the underlying technology of immutable, transparent data-base that cryptos operate on. However, instead of the currency being decentralised from any key entity, a CBDC is under the control of the issuing bank.

Back in 2020, already, according to a report by the Bank of International Settlements, 80% of central banks are in some form of researching and exploring the use-case and feasibility of a CBDC.

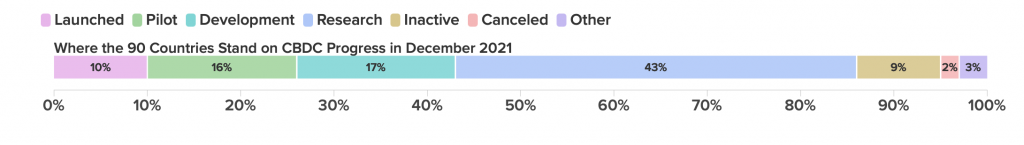

According to Atlantic Council’s CBDC tracker, at the time of writing, over 90% of the world’s total GDP are exploring the implementation of a CBDC. Since the initial concept was investigated, nine countries have launched a central bank digital currency, eight of which are found in the Caribbean, with Nigeria as the first country in Africa and the most recent country to launch its CBDC. According to Atlantic Council, 10% of the 90 countries currently looking at a CBDC have launched a CBDC, 16% are in the piloting phase, 17% are in development, 9% are inactive and currently not testing their CBDCs, 2% have rejected the concept, and the bulk of countries with 43% are in the researching phase.

In the latest news of central bank digital currencies, the Philines central bank, Bangko Sentral ng Pilipinas (BSP), along with the Alliance for Financial Inclusion recently announced the rollout of a pilot CBDC for the country. BSP govenor Benjamin Diokno announced the news in an recent event, explaining that the project will aim to develop a stronger payments system in the country that concentrates of safety and efficiency for the Philippines’ traditional financial system. As per the announcement, Diokno noted:

“The project aims to build organizational capacity and hands-on knowledge of key aspects of CBDC that are relevant for a use case around addressing frictions in the national payment system.”

He also noted that a CBDC will help address issues that the global pandemic has highlighted, such cross-border efficiency and financial inclusion. Not only does a CBDC aid in offering easier financial access across the world, but the costs are also greatly reduced with blockchain-based technology efficiencies. The report pointed out that remittance costs currently average around 6.5% of the amount set, which is signifantly higher than the 3% that the UN Sustainable Development Goals’s target.

The benefits, as noted by Diokno, still come with challenges and testing the CBDC will help determine what will be required to successfully pilot and launch a digital currency.

Diokno further emphasised the global intrigue of digital currencies across the world, noting that there are three countries in the Asian region’s ASEAN+3 that have already launched CBDCs for commercial use.

“There has been plenty of interest in CBDC projects globally. According to an analytical note released by the ASEAN+3 Macroeconomic Research Office (AMRO) as of December 2021, three central banks have launched CBDCs for commercial use; 14 countries have launched or completed pilot testing of CBDCs; 16 are in stages of development or proof-of-concept stage; while another 40 countries are currently undertaking research on CBDCs.”

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.