Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

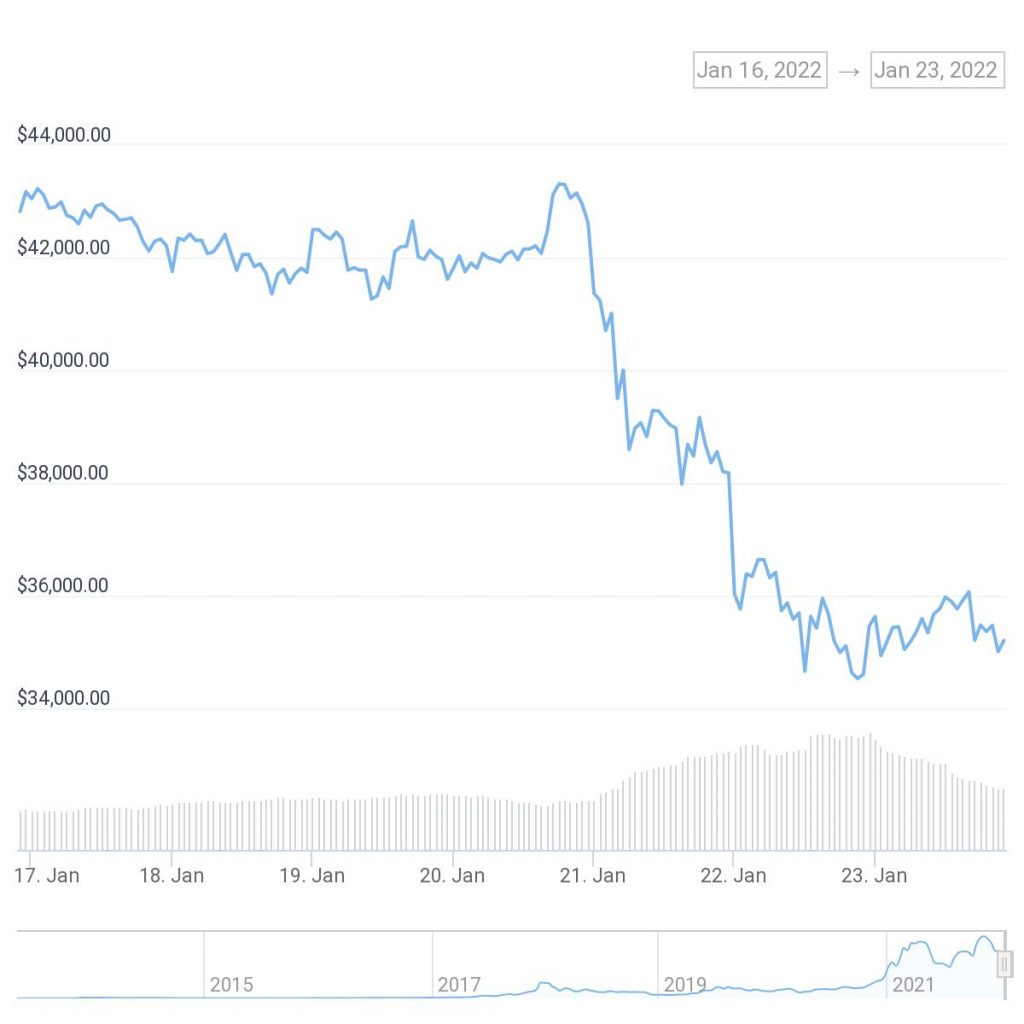

The cryptocurrency market took a massive knock, losing more than $205 billion USD across the market in just 24 hours at the end of the week. Over the weekend, the market hasn’t seen any sort of recovery and the bulls are concerned that the new week will bring with it new losses.

Looking at Bitcoin over the past week, the cryptocurrency was holding steadily above $40,000 USD. On Friday, it came crashing down from trading just above $43,000 USD to see a low of $34,587 USD. Over the past seven days, it has shed a 18.4% of its trading value, and over the past month it’s lost over 30% of its value.

Source: Coingecko

Looking at Bitcoin’s annual gains or losses, it has increased, gaining 7.0% from this time last year. While it might be in the green from a yearly basis, the loss over the past two months has been significant. From it’s all time trading high value of $69,044.77 USD that it tagged in November last year, Bitcoin has shed over 49% since then to its current $34,842 USD price. Since the beginning of 2022, Bitcoin has slipped by 16.6%.

Ethereum has also suffered a major setback, losing 27.8% in the past week’s trading. In the past month alone, Ethereum has dropped 41.5% of its trading value. When Bitcoin peaked in November, the leading alt coin also claimed a new record high value of $4,878.26 USD. Over the past two months, it has dropped by over 50%, and now sits at $2,402.94 USD. Since the beginning of the year, Ethereum has dropped by 24%.

Cardano, one of the leading altcoins that isn’t a stablecoin, has been wiped of 10.7% of its trading value over the past week and shed 28.2% in the past month. In September, it saw its all time high trading value of $3.09 USD. Since then, it has dropped 65.2% and now sits at $1.06 USD.

Solana, a utility token that is referred to as Ethereum’s biggest rival, has experienced a 35.6% drop in the past seven days trading and has shed 50% in the past month. Solana is valued above $95 USD at the time of writing, losing a massive 63.5% since its recorded high in November of $259.96 USD.

Dogecoin, the popular meme coin hailed by Elon Musk and Snoop Dogg, has also taken a battering in 2022. In the past week, it has lost 10.4%. Over the past month, Dogecoin has seen a 26.3% decrease and it’s looking at a massive 81.2% drop from its all-time high trading value of $0.731578 USD that it saw in May 2021. Now, it is sitting on a price of $0.135747 USD.

Source: Fortune

There are a number of factors at play that have resulted in the drop in crypto prices. The quick drop in cryptocurrency prices is not isolated to the digital assets market. The Nasdaq index took a blow earlier in the week, losing 5% since Tuesday and all major indexes were trading lower on Friday morning. The dipped week on Wall Street spilled over into the cryptocurrency market, which has already been struggling to pull itself back from a trading slump. Traders who pumped their funds before Bitcoin soared in November and sold-off un the festive season drew the market to a perilous place that it has been struggling to come back from.

Meanwhile, political pressure has been casting Bitcoin and other cryptocurrencies into further struggles. On Friday, the Russian central bank proposed a ban on the use and mining of cryptocurrencies on all Russian territory. This ban would result in a massive knock in the Bitcoin mining industry as Russia is one of the top three countries in the world that mines crypto. According to a report from the Russian central bank:

“Potential financial stability risks associated with cryptocurrencies are much higher for emerging markets, including in Russia. This is due to the traditionally higher propensity for saving in foreign currency and an insufficient level of financial literacy.”

The warning from the central bank might not do the market any favours, but more significantly, the potential for a blanket ban in one of the industry’s most important nations is a key factor in rattling investors who might have been sitting on the fence to sell or hold.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.