Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

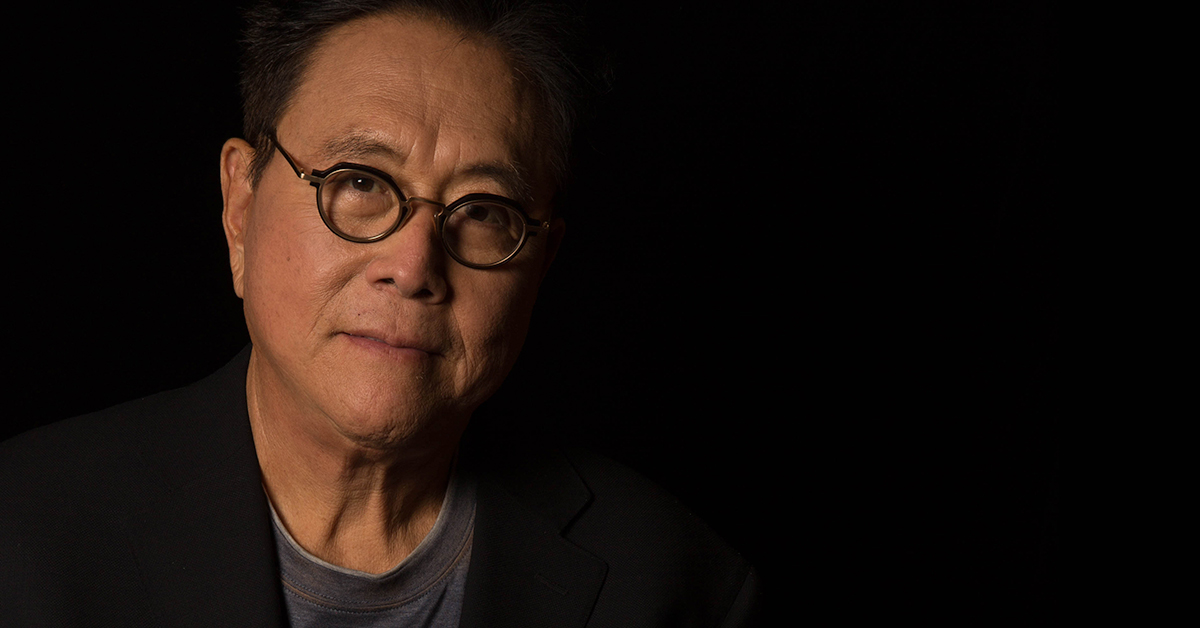

Author of Rich Dad, Poor Dad Robert Kiyosaki has reiterated his approach about the banking industry, pointing investors to gold, silver and Bitcoin

In a tweet, Kiyosaki commented that this is not a time to simply “think about” buying safe-haven assets:

WHY BUFFET is OUT OF BANKS . Banks bankrupt. MAJOR BANKING CRISIS COMING FAST. Fed & Treasury to take over banking system? Fed and Treasury “helicopter fake money” direct to people to avoid mass rioting? Not a time to “Think about it.” How much gold, silver, Bitcoin do you have?

— therealkiyosaki (@theRealKiyosaki) August 21, 2020

This is not the first time Kiyosaki has noted that Bitcoin is an asset that investors should consider adding to their portfolios. He has commented in the past that “Bitcoin is one of the biggest opportunities” for investors because it does not rely on the US Dollar or the federal banking system. Kiyosaki’s major pain point with the national banks is their ability to print money, which disrupts the supply and demand and risks major economic inflation. Safe haven assets with limited supply, he notes, are free from that risk.

This has been highlighted by the Coronavirus pandemic, as financial and economic stability across the world has been rocked. The US Dollar is already showing a decline in global dominance and value. As the banks continue printing more money, it is highly possible that this decline will continue until things stabilise again. For investors, this can be devastating to their funds, so finding an alternative asset safe from fiat decline is crucial at this time.

Ryan Alfred, president of Digital Assets Data, commented on how Bitcoin, which was initially launched as a transactional currency, has become a store of value:

“…Bitcoin is starting to behave more like a store of value and is potentially being used as a safe-haven asset during global uncertainty in traditional markets.”

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.