Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

Despite the general decentralisation found in the cryptocurrency industry, users of cryptocurrencies across the board are willing to comply with the new rule of the Financial Action Task Force (FATF) that will work with regulators and legal compliance.

According to a survey conducted by New York-based crypto compliance firm Notabene, the majority of crypto companies are either already practising the protocol in the regulations or are planning to complete their compliance before the second half of the financial year is over. The results from the survey show that approximately 70% of the respondents are willing to onboard the Travel Rule protocols into their operations.

56 businesses and companies across the world were surveyed, of which 45% are based in the Asia Pacific region, 30% are in Europe, Middle-East and Africa, and 25% are North American-based. 86% of the companies are cryptocurrency-focused firms and 13% have a banking license or are listed as a bank. As per the survey results, 31% of the firms polled are already adhering to the regulations set by the FATF’s Travel Rule, either completely or partially. 92% of the companies have internal legal and compliance departments and 78% would confidently state that the teams can guarantee that they are acting in accordance within the regulated framework, at both an external and internal level.

Source: Notabene

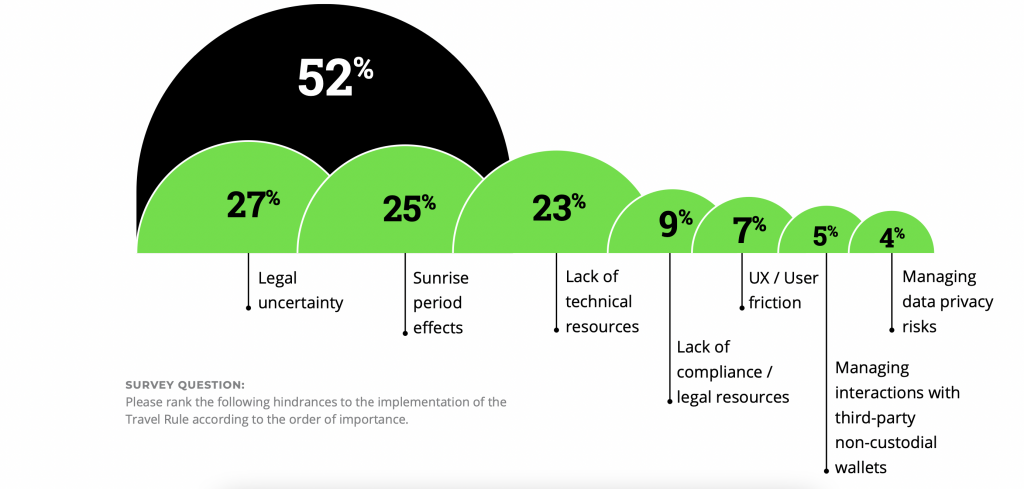

According to the poll, the key hinderance to companies that have not implemented the Travel Rule protocol into their operations point to the sunrise period and legal uncertainty. 23% of firms point to a lack of technical resources, 9% state that the lack of compliance resources, 7% say that user friction are an obstacle to implementing the Travel Rule. Of the firms that have not yet implemented the Travel Rule into their systems, however only 4% have reported that the regulation is not a focal area in their operations. In terms of ‘readiness to adopt the Travel Rule’, 57% of the companies report that they are in the research phase with 32% of these having allocated a team to the process but not yet begun and 25% having started the research but not yet having a roadmap. 39% are implementing the regulations, with 25% of these having started implementation but are not ready to go live and 25% ready to roll out.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.