Cryptocurrency is set to become even safer, according to data and research into cybercriminals activity.

Kim Grauer, the director of research at Chainalysis, has shared insight into how regulation and cybersecurity companies are working to mitigate cybercrime related to cryptocurrencies in the next year. According to Grauer, this coming year is likely going to see a decrease in crypto-related crime as laws across the world are implemented and countries start to adopt blockchain technology into their traditional systems.

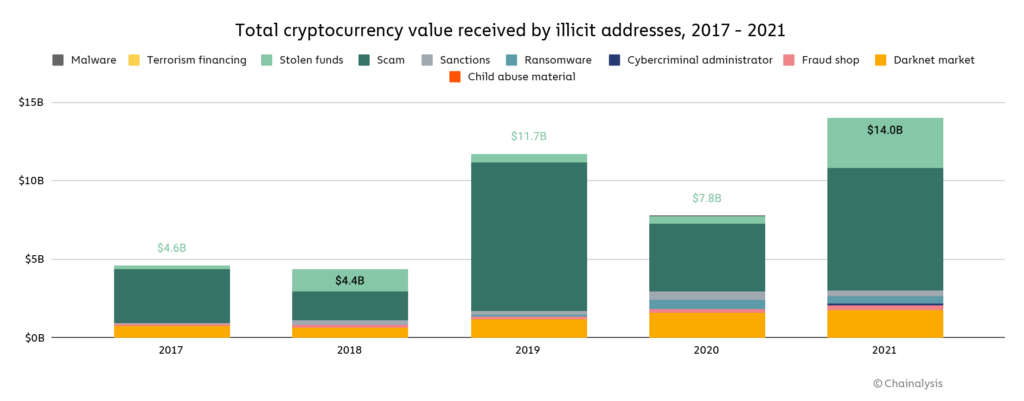

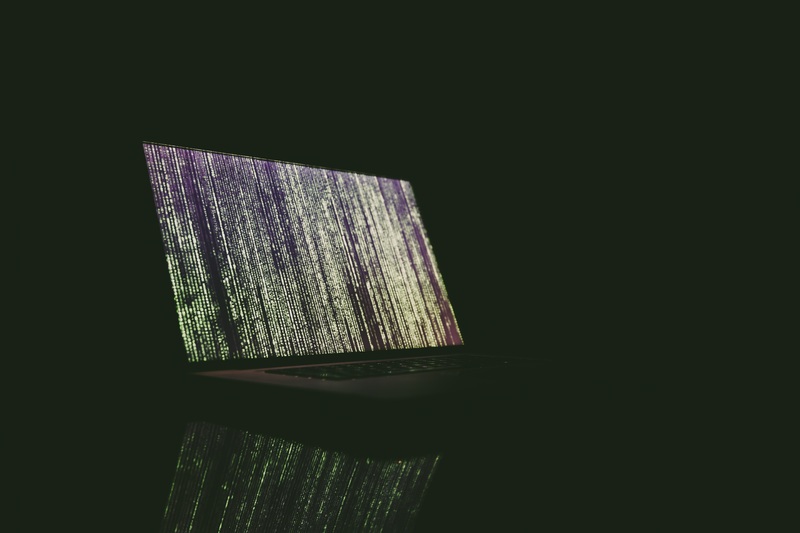

Source: Chainalysis

Looking at the chart as part of a report from Chainalysis, the total funds stolen and scammed from users hit an all-time high in 2021, increasing from $14 billion USD, up from $7.8 billion USD. However, it’s important to recognise that over the past year, the number of cryptocurrency users and investors in cryptocurrency has increased faster than ever before. According to Chainalysis’ tracking of cryptocurrencies, the total transaction volume in cryptocurrency has grown from 2020 by a massive 567% to see $15.8 trillion USD change hands over the course of 2021. With the massive spike in adoption and new users, it’s only natural that there would be an increase in those who have experienced cybercrime in the industry.

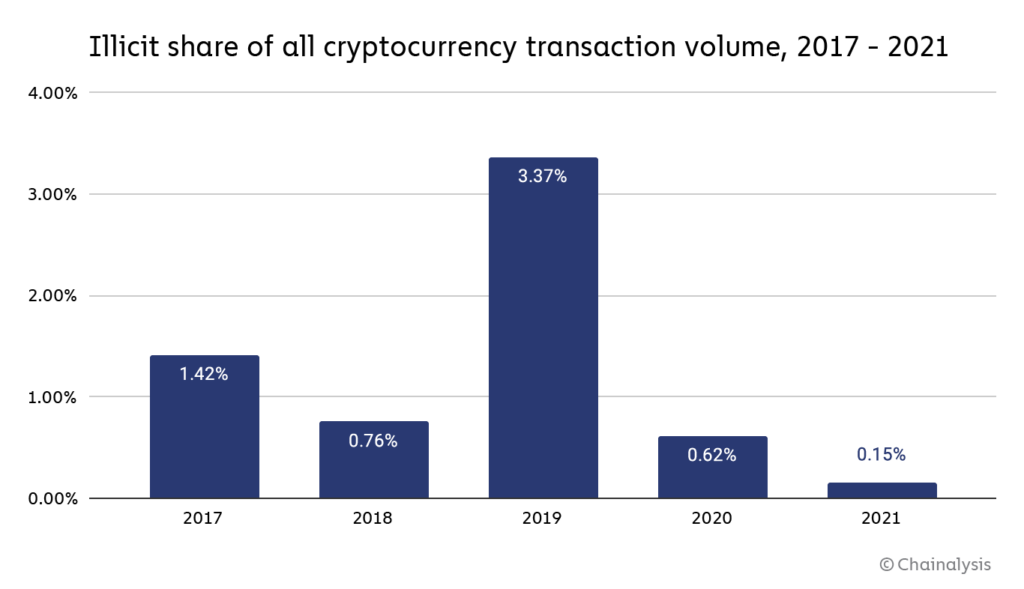

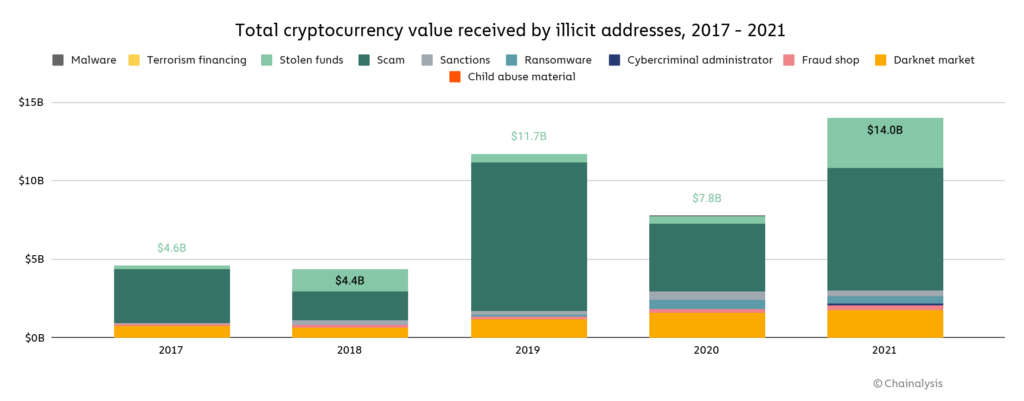

Looking at the 567% increase in transactions, an increase of 79% in cybercrime spells security increases in the industry. The growth of legitimate cryptocurrency usage has been far outpacing the use of cryptocurrency for criminal or illicit activity and the portion of illegal activity in the industry has been smaller than ever. Looking at a chart that takes this into consideration changes the story and paints a different picture of the increase of cybercrime in the overall emerging industry. In 2019, the illicit share of cryptocurrency transaction volume was sitting at 3.37%, which can largely be attributed to the PlusToken Ponzi scheme which saw millions of dollars scammed from users. This figure dropped to 0.62% in 2020 to drop even further to only 0.15% in 2021.

Source: Chainalysis

An increase in cryptocurrency scams

Looking at where funds went missing, scamming revenue rose by 82% from 2020 to 2021 with $7.8 billion USD worth of cryptocurrency stolen from victims over the year. Of this, more than $2.8 billion USD has come in from “rug pulls”. This refers to a scam project that developers build that appears to be completely legitimate with functionality beyond investment, gaining attention, taking users’ funds, and then disappearing with investors’ money. As per the report from Chainalysis:

“We should note that roughly 90% of the total value lost to rug pulls in 2021 can be attributed to one fraudulent centralized exchange, Thodex, whose CEO disappeared soon after the exchange halted users’ ability to withdraw funds.”

It has been suggested that rug-pulls and decentralised projects that appear to be genuine might remain the most prevalent of the scams seen in 2022, with the DeFi and NFT industries building at such a rapid rate. As more people lean towards decentralisation, so fo more opportunities for scams emerge.

The rise in decentralised finance scams

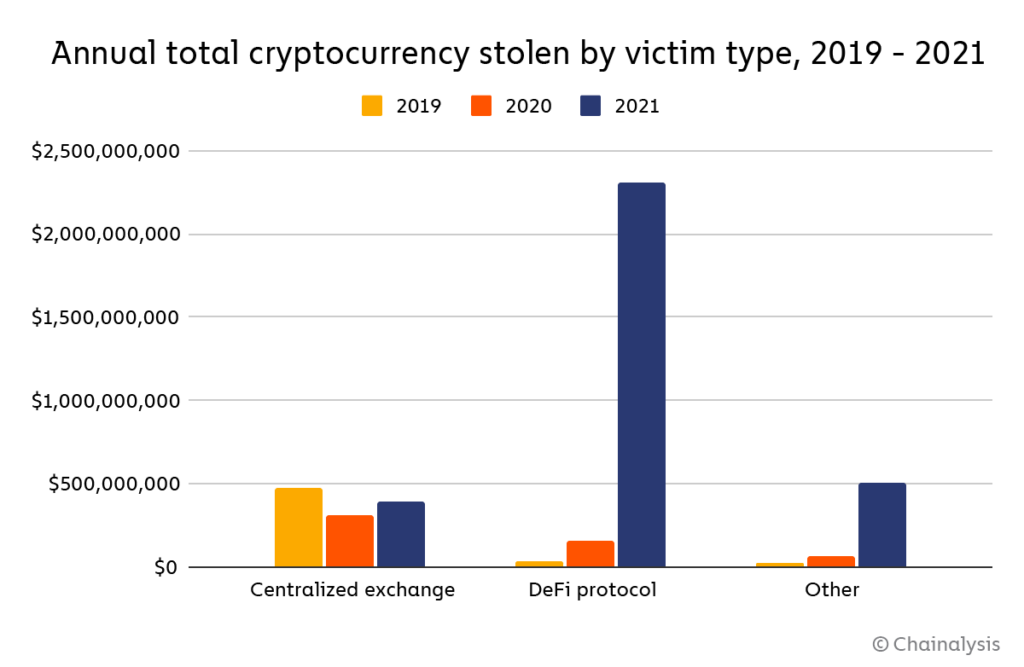

Two reasons why DeFi-related scams have become so prevalent are:

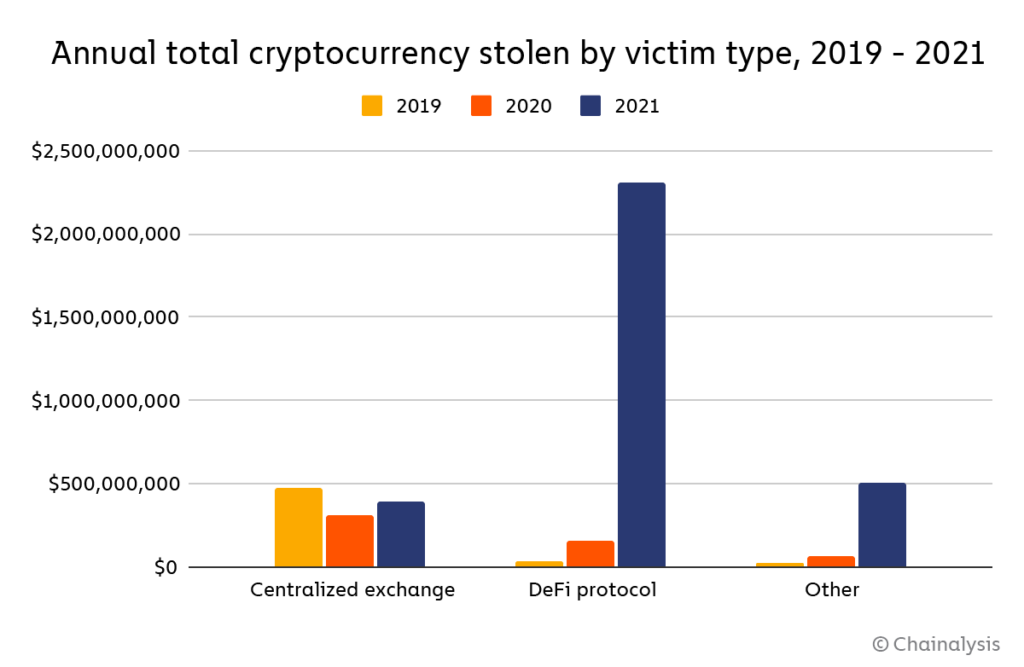

- The massive increase in how much attention the space is receiving. DeFi transaction volume has grown by nearly 1000% in 2021, representing a massive new user base and hype in the space.

- How easy it can be to list a DeFi token with a code audit (meaning any developer with enough technical skills can create a new token and list it and see investment come in. As we can see, the amount lost to DeFi protocol-related scams in 2021 rose tremendously, increasing by 1330% from 2020 to 2021.

Source: Chainalysis

Making cryptocurrency safer

With all cyber-related activity, caution is always the best port of call when investing. To make cryptocurrency even safer, as more regulation and the national sector action comes into play, we’ll see investors receive greater protection and understanding to safe-guard against cybercrime and illicit crypto use.