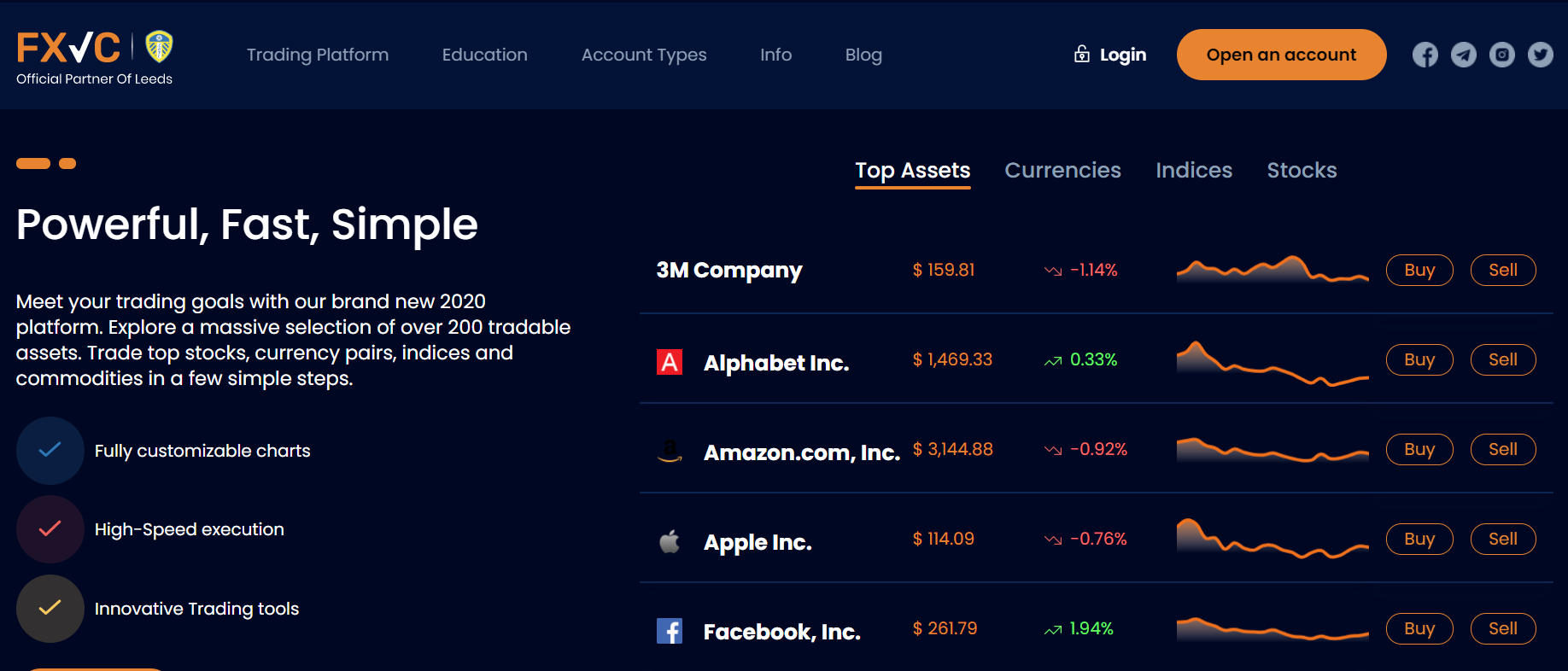

FXVC is an online trading and investment platform for traders in Europe and South Africa. FXVC offers new traders the ability to trade with over 250 financial CFD instruments, including Forex, Crypto, Commodities, Stocks and Indices. All of these instruments can be traded on the website, which has fully customisable charts, high-speed execution, customer service support and cutting edge trading tools. FXVC also provides traders with a low-latency environment that is backed by extensive price feeds.

What is FXVC?

FXVC was founded in 2014 and it is an official Leeds United Platinum Partner. The broker is regulated by the Cyprus Securities and Exchange Commision (CySEC), under Centralspot Trading Limited.

Traders have the option to choose from five different minimum deposit amounts and added benefits such as discounts, access to trading signals and other additional resources.

Some other key features include:

- Transparent pricing

- Simple deposit and withdrawal process

- Over 250 popular trading assets

- Educational resource library

- Multiple platforms for convenient & efficient trading

Is FXVC a Scam?

FXVC is regulated and its licensing is provided on the website. The company is fully transparent where the compliance is concerned and reassures clients that their safety is of maximum importance. Traders are always advised to make sure they do enough research on the chosen broker before opening an account. However, where FXVC is concerned, there are a number of positive reviews to reassure potential traders about their credibility.

Pros and Cons

| Pros | Cons |

| ✔️ Regulated & authorised | ❌Limited assets and instruments |

| ✔️ User-friendly web-based platform | ❌ Limited trading tools |

| ✔️ Daily trading newsletter | ❌ No MetaTrader4 platforms |

| ✔️ One on one academy | ❌ Minimum of $2,500 is required |

| ✔️ Daily & weekly market review | ❌ Key features require an account size |

| ✔️ Trading central signals | ❌ Inactivity fee is charged |

Regulations

FXVC is a trading name of Centralspot Trading Ltd and is authorized and regulated by the Cyprus Securities and Exchange Commission, referred to CySEC. CySEC is one of the most credible regulators when it comes to online brokerage platforms. CySEC’s main aim is to supervise and control licensed companies that offer investment and CFD services. CySEC is an EU member state and its financial regulations and operations comply with the European MiFID financial harmonization law.

It is also reported that FXVC have incorporated advanced security. This security feature has been implemented to protect a traders personal and financial information. This broker prioritises traders security. FXVC also complies with the KYC guidelines regulated by authorities. Usually, brokers who have verified licenses can be counted as credible or legit.

Here are some of FXVC’s licensing details found in media reports:

- FXVC EU is owned by Centralspot Trading (Cyprus) Ltd, which is regulated by CySEC with license number 238/14. They are located at: Gladstonos 110 Corner of Mesologiou Street, Ayia Trias 3032, Limassol, Cyprus. Phone number in the United Kingdom is: +442039361455.

- FXVC Australia is owned by Intelligent Financial Markets Pty Ltd. They are licensed by ASIC with AFSL license number 426359. They are located at: Level 33, Australia Square, 264 George Street, Sydney NSW 2000 Australia. Email address is: support@fxvcservices.com.au, and their phone number is: +61283113274.

In Which Countries is FXVC Available?

FXVC is available in Europe and South Africa. Unfortunately, FXVC cannot accept traders from the United States.

Available Trading Platforms

Unfortunately, FXVC does not use the popular MetaTrader4 Platform, however, traders can launch the FXVC WebTrader platform directly from the brokers browser. The platform is web based and new traders only need to log into their account. No software or App needs to be downloaded for the trader to access the platform. The platform is reasonably user-friendly, however, it has limited functionality, depending on which account is chosen. There are also a variety of different instruments to choose from on the platform and the chart can be customised to the traders preference.

How Does FXVC Function?

FXVC has an impressive offering. New traders have access to more than four types of trading assets and provide traders with a hedging functionality, to guard against the volatility of the market. It has been reported that FXVC operates at a high level and the level of service is excellents as well. The company has been reported to be credible and reliable when it comes to assisting new clients with executing trades. This broker is browser based, while many experienced traders may prefer the MetaTrader4 platform, the browser based platform does not offer a bad experience at all. In fact, from our observation, we would encourage more brokers to implement this option as an additional account feature.The tiered account feature is an added bonus. Traders can choose the account best suited to their affordability.

The FXVC Economic Calendar

An Economic calendar is mainly used by investors to monitor the market and events, including economic indicators and monetary policy decisions. These events are usually announced or released in a financial report. FXVC provides their traders with accessibility to an Economic Calendar powered by Trading Central. Traders can view the date and time of economic events in real time. This tool is instrumental in successful trading decisions and can be used for forecasting and trading strategy. The calendar can also be filtered down to the trader’s interests.

Educational Tools

FXVC does provide traders with educational resources and content which can assist new traders with the experience and knowledge to make informed trading decisions. This content includes tutorials, videos and market analysis. Other educational resources include:

- Market analysis: this is basically in depth information about the current market to assist traders in making decisions.

- WebTV: the WebTV section is an inspirational space that includes videos on different markets around the world.

- Trading glossary: the trading glossary demystifies terms from A-Z to assist brokers in understanding the market.

Trading Instruments

FXVC offers clients over 250 instruments for online trading from the following asset classes:

- Commodities

- Stocks

- Forex

- Cryptocurrencies

- CFDs

Trading Accounts

FXVC has five different account options for traders to choose from. This includes Bronze, Silver. Gold, Platinum and VIP account. The minimum deposit starts from $2,500 on the Bronze account. You may notice that this amount is much larger compared to other brokers. The larger the account size, the lower the commission charged. The maximum leverage charged to a trader is 1:30 for clients who are considered non-professional.

Here are the minimum deposits required for each account:

- Bronze:€2500

- Silver: €5000

- Gold: €10,000

- Platinum: €25,000

- VIP: €100,000

Demo Account

The platform also offers a demo account feature for free, upon joining.The demo account allows new traders to experience the platform, risk-free with virtual money.We recommend that all new and experienced traders make use of a demo account to gain experience and make themselves comfortable. Islamic accounts that have to comply with the Sharia law are also available.

Traders who qualify as professional clients have to possess a portfolio of of greater than $500, that does not include property or cash, a verified trading history, and a proven track record of handling a professional position that involves derivatives.Professional traders are classified under the ESMA regulation, which means that this type of account has limited by a negative balance protection, Investor Compensation Fund and Financial Ombudsman services. Brokers fees constantly change. It is important to look out for fees that are not mentioned in this review. We recommend that all new traders read up on all the information possible regarding their broker.

Key Features of a Professional Trader/Client Classification

- Trade with higher leverage: this benefit is probably one of the most significant that comes with professional trader classification. Traders have access to high leverage, which means that traders will be allowed to trade using a variety of trading strategies, while using less funds for a more flexible money & risk management trading experience. Leverage also brings the risk of bigger losses.

- Keep Negative Balance Protection: Usually, brokers are not required to segregate the funds of a Professional Trader from their own funds, which means they could deposit them to liquidity providers and if those liquidity providers go out of business, your funds could be lost. At FXVC, we segregate all our client’s funds from the own funds and we continue offering you the negative balance protection for both Retail and Professional traders that will prevent you from losing more than what you invested.

- Best Execution Policy: With other brokers you may lose your right to best execution policy according to its definition from the applicable regulation. Best execution policies for retail traders require their brokers to give priority to executing their order with the best possible price. This factor prevails other considerations like execution speed, size of your order, current market depth etc. which all play a part in the quality and outcome of your order.

- Communication and Risk Disclosure: FXVC is fully transparent with the risks involved with trading, especially in the volatile cryptocurrency market. According to the broker, new traders do not have to be concerned with any hidden clauses or any other surprises.

Customer Service

FXVC traders have access to a whole team of dedicated customer service support. This team aims to maintain the relationship between a broker and trader. According to the broker, the customer services support team is highly efficient, with a quick turnaround time. The customer service team can assist with any query or concern that customers encounter while trading on the platform. There is an online form available on the homepage of the website, alternatively there is a telephone number and email address on the website too. A live chat functionality is another way of reaching the customer service support team.

Deposits and Withdrawal

It is reported that FXVC has a seamless deposit and withdrawal process. This broker accepts a variety of different payment methods including Wire Transfers, Credit and Debit cards, Neteller,, Skrill and a few others. Not all methods are available for deposits and withdrawals, it depends on which country traders are from. According to the broker, withdrawals can be processed within 24 hours. It is important to note that traders can only withdraw using the same bank account that funded the FXVC account initially. This is an added security feature.

Some fees may be charged using certain payment methods. Some payment methods have transactional limits and restrictions. This is indicated on many other websites too. Further verification may be needed to lift these restrictions from an account. FXVC does not accept any third party payment. All the details on an active trading account has to correlate with information provided upon signing up. The website is also protected by an SSL certificate, which protects traders against fraud or theft. All accounts can be opened using USD,EUR, and GBP.

How to Open an Account

Opening an account is quick and easy, and should not take more than 20-30 minutes, unless the trader has problems verifying information. On the homepage, there will be an “open an account” button, that will open up a short form for new traders to complete. The trader will be prompted to provide information such as the full names, contact number, email address and country they’re residing in. Once this information is submitted, the trader will be required to verify the account. This is why it is important for new traders to submit information that is accurate, else the account will be unsuccessful upon verification. Usually, a governmental identification document is required and proof of address.

It is important to note that a deposit is not required when registering, however it is required to activate the account for live trade. The demo account can also be used without making a deposit. If you do run into any problems while attempting to register, the customer support team will be able to assist.

Leverage Limits & Trading Margins

To open a transaction in CFDs and leverage certain products, the trade must undertake to provide the Initial Margin in the trading account. To keep transactions open, traders must undertake to ensure that the equity in the current account equals or exceeds the Maintenance Margin. It is important that new traders acknowledge that the margin for each instrument differs and that it is within the brokers right to change the margin requirements seasonally, with proper notice.

- Here are the leverage limits and trading margins for each asset class: comply with the 30:1 for major currency pairs;

- 20:1 for non-major currency pairs, gold and major indices;

- 10:1 for commodities other than gold and non-major equity indices;

- 5:1 for individual equities and other reference values;

- 2:1 for Cryptocurrencies

Our conclusion

After reading many reports and positive reviews online, we believe that FXVC is a credible broker that could potentially provide traders with high returns. Of course the cryptocurrency market fluctuates daily, but is important that new traders do the necessary research to make sure they are always making informed trading decisions. We recommend reading up on the positive user testimonials and feedback that exists online. FXVC is one of the more expensive brokers out there, since the broker charges a high minimum deposit. However, we recommend that potential traders have a closer look at the features of each account before deciding to dismiss the broker.

FAQs

- How can I verify my account?

The following documents are required in order to verify your account:

- Government Issued Identification: a colour copy of a valid Government issued Photo ID, such as a Driver’s License, National Identity Card or a Passport. Expiration date must be valid. The entire document must be present in the copy uploaded including full name, ID number, photo and expiration date.

- Proof of Address: Colour Copy of a valid Utility Bill as proof of your current address. This can be a payment request/receipt, sent to your legal address, such as Water/ Electric/ Gas/ Internet/ LandLine Phone bill, or a recently issued bank statement. In order for it to be approved, the utility bill/bank statement must be issued within the last 6 months of submission. The entire document must be present in the copy uploaded including your full name, address, issuance date and utility company logo.

- Credit Card: If a Credit Card was used to fund the account, we require front and back colour copies of the Card.

- Depending on the deposit method, the company reserves the right to request additional documentations to ensure proper client verification.

- What currency can I use for trading?

You can open an account in EUR, GBP or USD.

- Do I have to deposit money for registration?

No. A deposit is not required to open an account. Only a live account requires a deposit.

- Are payouts taxed?

Traders are responsible for their own tax liability.

- If I’m having problems registering, what do I do?

You can contact the customer service team for assistance in this regard.

- What is the registration fee?

There is no registration fee required.

CFD Glossary

| Term | Definition |

| Contract for Difference (CFD) | A Contract for Difference is a well-known type of financial derivative instrument, much like indices, commodities, currencies,etc. |

| Contracts for Difference (CFDs) | A formal agreement between two parties/people to pay the difference in price from when the contract was opened until the contract is closed. |

| CFD Trading | Investors have the option to go short (sell a CFD) if they think a price will decrease or go long (buy a CFD) if they think the price will go up. |

| Margin | The margin refers to the minimum deposit required. |

| Initial Margin | The initial amount required in order to open the position. It is often also referred to as an initial deposit. |

| Average True Range | ATR refers to the measure of market volatility over a specific period of time. |

| Back Testing | Back testing occurs when a strategy is put to the test, by using historical data for validation. |

| Base Currency | The first listed currency in a pair. |

| Commodity CFD | A type of CFD that derives its value for an underlying commodity it’s meant to track. |

| Consolidation Market | A market that is stagnant, neither moving up or down. |

| Currency Pair | Forex is trading in currency pairs. It refers to the price quoted in terms of the relative values of one currency against another. |

| Leverage trading | Also referred to as margin trading. The process in which an investor borrows a large amount of money from a broker to open a larger position. |

| Leverage ratio | The amount of leverage/money provided by a broker to trade a leveraged product. The amounts typically offered are 5:1, 10:1 and 30:1. |

| Maintenance margin | The amount of minimum funds needed to keep positions on the account open. |

| Used Margin | The amount of money that is currently used to keep positions open. |

| Equity | The total value in an investors account. |

| Free Margin | Funds available on an account to trade with (not currently being used by open positions). |

| Overnight charges | A Fee charged by a broker for holding a position over night. It is also referred to as an overnight financial charge and is linked to the interest rate of the currency being traded. |

| Buy position (“going long”) | A long position is the purchasing of an asset, with the expectation that its value will increase. |

| Sell position (“going short”) | A short position refers to the sale of an asset. with the expectation that its market value is set to fall. |

| Slippage | The difference between a requested market price and the actual price the trade was filled at. |

| Debt-To-Equity Ratio | The ratio of the total debt of a company to the amount of capital that shareholders have invested in the company. |

| Derivatives | A financial instrument that obtains its price from underlying security, index, currency pair or commodity. |

| Donchian Channel | An indicator that has two boundary lines determined by the highest and lowest points. |

| Downtrend | A series of lower highs and lower lows in the cryptocurrency market. |

| Earnings Per Share (EPS) | The profit the company makes is divided by the number of outstanding shares the company has. |

| Ex-Dividend Date | The very first day, a buyer of a share no longer obligated to a payment of the dividend the stock (or CFD) offers. |

| Exposure | The sum total value of all your positions in the market at any particular time. |

| Finance Charge | The price charged to hold a given position from one trading day to the next. This charge is generally calculated, based on the country’s cash rate plus a small interest charge. |

| Fixed-Dollar Model | A certain fixed-dollar model, where a certain amount is allocated to risk on any given day. |

| Fixed Percent Risk Per Trade | This refers to a risk management model where a certain amount of money is allocated to overall trading capital. |

| Forward Testing | Testing a strategy in real time, while the movements in price unfolds. |

| Fundamental Analysis | A method developed to evaluate the value of a company relies on financial statements, PE ratios, future growth projections and company financial statements. |

| Post-market Auction | The last available trading opportunity for the day before the market closes. |

| Pre-Market Auction | The identical matching out of prices |

| Price-to-Earnings Ratio (PE) | Determining the projected worth of a project by dividing the current market price by the earnings per share. |

| Product Disclosure Statement (PDS) | A document held by every financial services company, to provide to their clients regarding their products or services. This document will outline how the product in question worked, its potential benefits, and associated risks. |

| Pyramiding | A rule where traders add to their existing position(s) in an attempt to maximize the potential profits on winning trades. |

| Range-Bound Trading | Trading in a range where the value fluctuates between two main points. The two points are typically referred to as “Support” and “Resistance.” |

| Return On Equity (ROE) | The return a company generates based on the net assets they hold. |

| Return On Investment (ROI) | The amount of return you’ve realized on your deposited capital. |

| Scaling In | Initiating a trade by opening a small position in order to determine your readiness to bring it up to a normal position. |

| Scaling Out | Gradually closing your trade as it moves in your favor or reaches some specified profit objective. |

| Technical Analysis | Any mathematical formulas used over the price and/or volume history of the market in an effort to determine the probable next move of any particular asset. |

| Volatile Breakout Trading | A type of trading strategy that attempts to take advantage of short, sharp movements in the market over relatively short periods of time. |

| Volume | A measure of the number of shares or contracts that are solidified over a set period of time. |

| Trend-Following Trading | A trading strategy that attempts to profit from markets that tend to move either up or down for extended periods of time. |

| Trend Line | A line drawn across a chart to line up successively higher bottoms in up-trending markets |