Risk Management in Crypto Trading: Simple Rules to Follow

The rules of the risks attached to cryptocurrency trading don't need to be impossible to follow. In this, we explore risk trading and how...

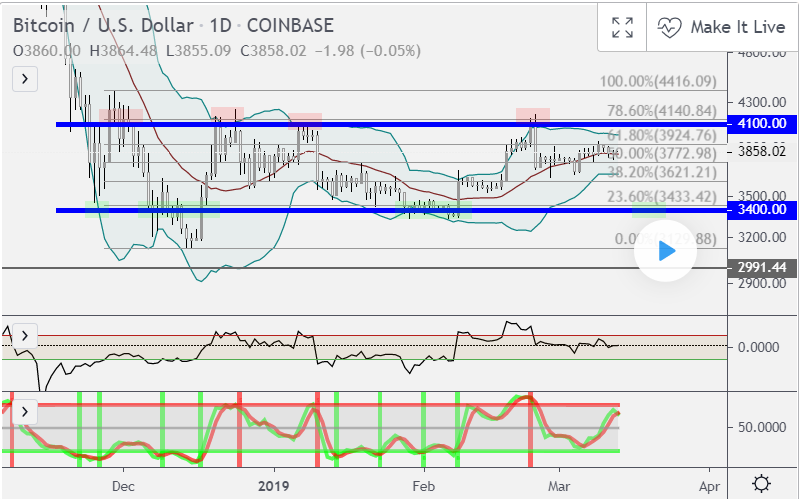

BTC Daily: How to Profit Range Trading 101 by WolfpackCrypto on TradingView.com

When an asset falls into a range this is where the market separates the pros from the hobbyists. Why is trading in a range so difficult? In most cases, a range is built after a volatile period and assets get stuck in a range bound area of the chart after coming off a huge selloff or a pump. Why does this happen? Think of the market as energy and it literally takes electricity to move markets up and down. Like everything else, markets want to come back to a state of equilibrium. So this range bound area represents consolidation or equilibrium state. So what makes range-bound trading so difficult? Simply put it’s the psychology. Think about it. It’s like being in a volatile relationship that is constantly up and down. When you get back to equilibrium with your partner you still have the after-effects of what happened. You might be hyper-sensitive in situations you shouldn’t be. Maybe you read into things more than you should. It’s no different when it comes to trading. Denying the fact that trading is not an emotional sport is simply you not being honest.

So, now you’ve come to accept this is an emotional sport and that you need to manage your emotions let’s segway to the following suggestions:

1) Establish the range. There should be multiple horizontal touches on the top and bottom.

2) What indicators work well in a ranging market? Use Bollinger Bands + Commodity Channel Index to identify overbought + oversold conditions

3) Understand markets can range from long to short term periods so have a plan on where to place stops so you can maximize any moves to the upside or downside

4) A market is ranging until it isn’t. What do I mean by this? Draw out on your chart possible paths using Fibonacci levels on what a realistic breakout would look like either to the upside or downside. Go back in history to find out how the asset moved out of a range and plot it in the future.

5) Ranging markets will leave dead bodies everywhere. People will over position size, get the timing wrong, will get stopped out for losses and will get wrong-footed. Why? People move away from what their indicators are telling them and are feeding into the psychology of the market and trading emotional instead of objectively.

Don’t fall into the trap of trading emotionally ever, but especially in a ranging market. During such periods of consolidation is when you hear twitter experts calling for a huge breakout or others calling for a doomsday. This period usually is associated with lower volumes and volatility so traders are getting impatient.

So this is when you need to adopt the Jedi mindset and trust your indicators. Only buy/sell when things get oversold/overbought and trust the indicators and the top and lower bound of the ranges. Until the asset breaks out of this range this gives you an overall target on when to trade. The Bollinger bands tighten things up a bit more and give you more focused areas to buy/sell.

Also DYOR on the Bollinger bands + CCI indicator and how you can use these to successfully range trade. There are a lot of helpful articles and videos to allow you to be profitable during these tricky phases and how to maximize these trading indicators.

Regards,

Bobby

The rules of the risks attached to cryptocurrency trading don't need to be impossible to follow. In this, we explore risk trading and how...

Learn where and how to buy Bitcoin. Find out where to store it once you have bought it.

Learn what social trading/copy trading is and how this is one of the best ways to trade for beginner traders. Find out which are the best...

If you are interested in CFD trading and wanting to learn how to make money from trades, here are a few tips and tricks to help.