Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

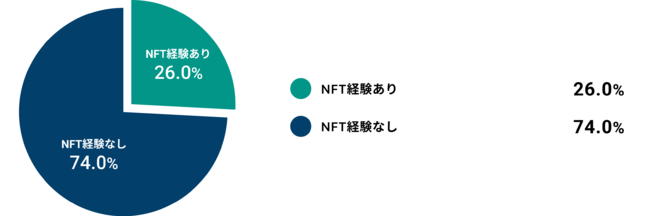

Over 25% of cryptocurrency investors in Japan have dabbled in investing in and holding non-fungible tokens (NFTs) according to a new survey researching the interest of cryptocurrency traders in the NFT market.

BitBank, one of Japan’s leading cryptocurrency exchanges, conducted a survey to users about their investment interests in the digital asset market. According to the results, BitBank found that 26% of Japanese cryptocurrency investors have held NFTs in their time investing in cryptocurrencies. With over 2,000 cryptocurrency users, including clients of BitBank and anonymous users on Twitter, the respondents answered between October 26th and November 1st.

Translation:

26%: Crypto asset investors have NFT ownership experience

74: Crypto asset investors do not have NFT ownership experience

Source: BitBank

According to the survey results, the majority of NFT investors in the Japanese market are in the younger generation, ranging between 20 and 40 years old. Most of the respondents noted that they’re interested in holding NFTs for the same sort of reason for holding Bitcoin – for a long-term investment opportunity and for holding the asset to see it gain value over time. The results from the survey showed that up to 60% of those who have held NFTs took to the industry to hold the tokens as a long-term investment.

As it stands, nearly 39% of those who stated that they had held NFTs are still holding their tokens, but are unsure of the value of their NFTs. 22% of the NFT holders are also holding their tokens, but know what the value of the digital assets is. Only 19% stated that they had sold their NFTs, but noted that they had benefited from the sale, making a profit from the assets.

According to the report, the main theme behind the NFTs in the Japanese region is in the art industry with 68% of NFTs being designed as digital art. However, other NFTs are related to games, the Metaverse (such as The Sandbox and Decentraland), entertainment and sports’ tokens.

According to Google Trends, we can see that interest in the NFT market in Japan has increased considerably over the past 12 months, with search rates rapidly growing.

According to data from Google, the majority of those searching the market for NFTs are in Tokyo, followed by investors in Okinawa Prefecture and Kanagawa Prefecture. Investors in the regions are also looking for digital art, as well as exploring Ethereum and Binance.

Coincheck released an NFT marketplace in March 2021 to offer Japanese holders a platform to buy and trade their NFT assets. The marketplace has been focused particularly on partnering with companies that offer investors the opportunity to buy and hold fan tokens from famous sports clubs including FC Barcelona and Juventus. Fan token platform Chiliz and Socios CEO Alexandre Dreyfus commented at the time on why opening up the space is important for fans, saying:

“We’re really focused on NFTs in 2021 and have the potential to launch them with every single one of our partners. We’ll also be looking to give them a certain utility — for instance the chance to redeem rewards linked to the particular club.”

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.