Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

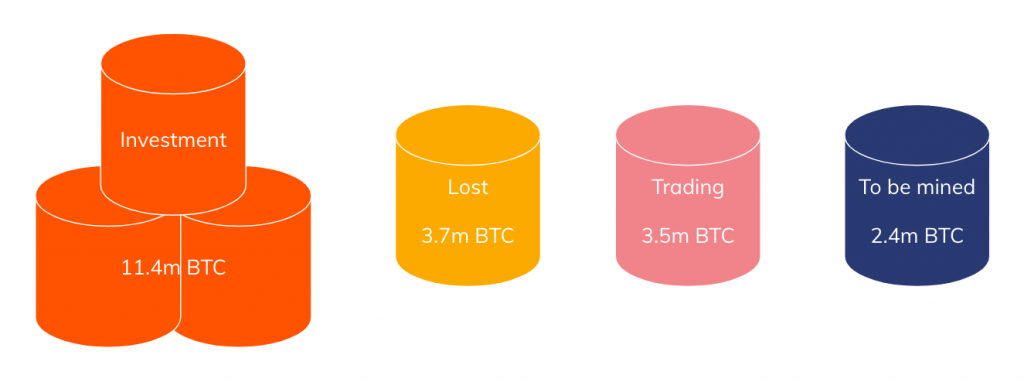

A recent report by Chainalysis shows that the majority of Bitcoin is stored as a long term investment, leaving a surprisingly small fraction of tokens available for trading.

The data shows that 11.4 million of the 18.6 million Bitcoin that has been mined is sitting as an investment. A shocking 3.7 million Bitcoin is reported as lost, which is measured by Chainalysis as inactivity over the past five years. With 2.4 million Bitcoin still to be mined, this figure, as demonstrated below, leaves the remaining Bitcoin which has been already been mined for transactional or trading purposes at 3.5 million Bitcoin.

This places the 3.5 million in high demand for trading, which has a direct influence on the market movement and price of the cryptocurrency As Chainalysis states:

“More people looking to trade Bitcoin, which is only becoming more scarce following the recent halving, Bitcoin moving from the investment bucket (or potentially even the lost bucket if the earliest adopters still have their private keys) into the trading bucket could become a crucial source of liquidity. However, one would expect this will only happen if Bitcoin’s price rises to a level at which long-term investors are willing to sell.”

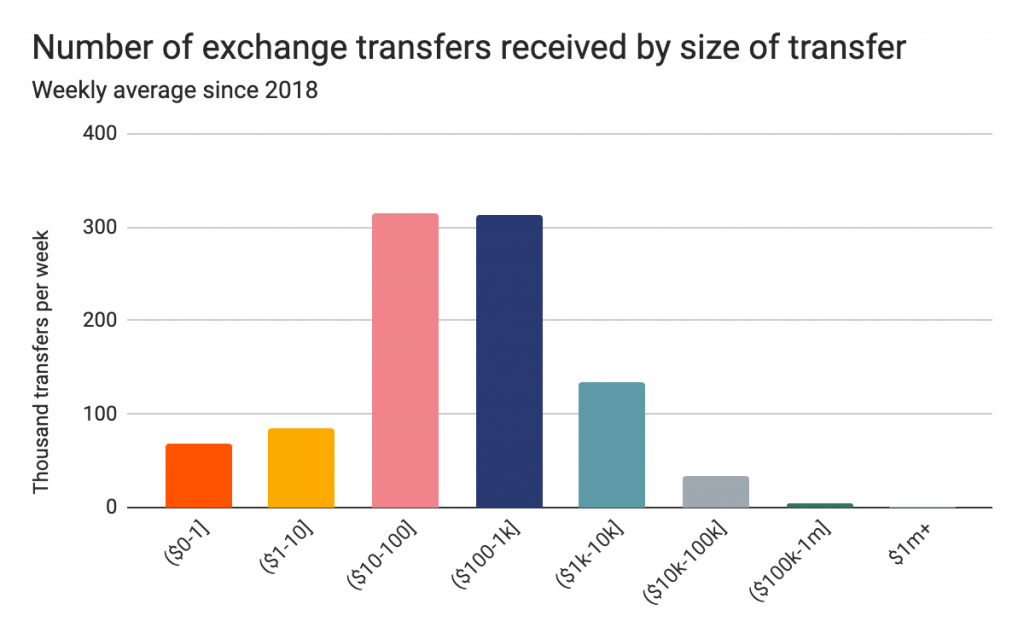

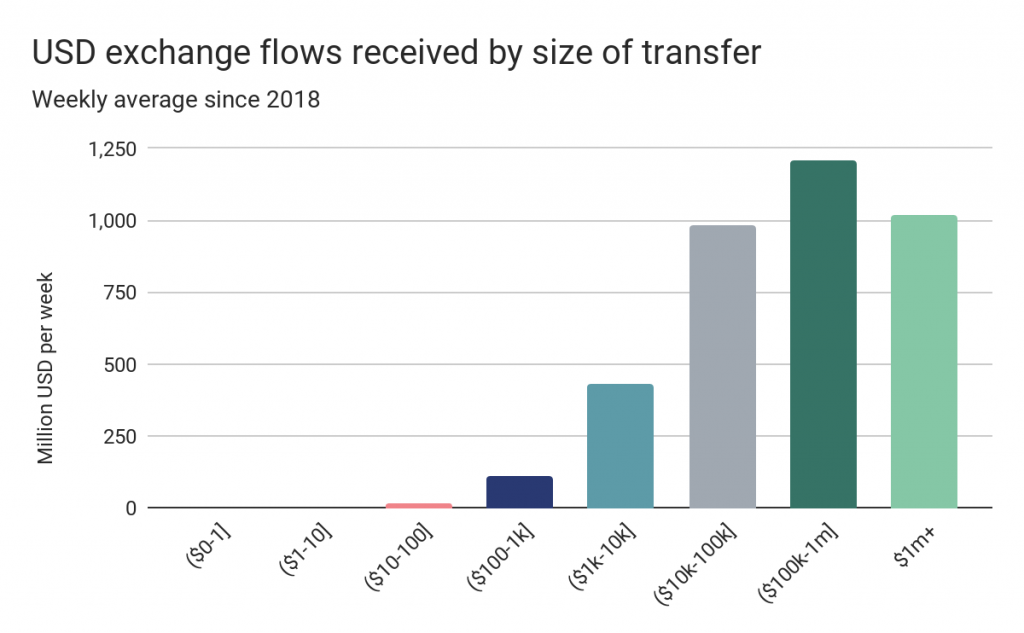

According to Chainalysis’ data, there are more retail traders but “professional” traders account for higher volumes of Bitcoin trading Categorised as those who deposit less than $10,000 USD worth of Bitcoin at a time, retail traders account for appear to make up 96% of all transfers sent to major listed exchanges

Professional traders, reported as those trading more than $10,000 USD at once, account for 85% of all the USD value of Bitcoin value sent to exchanges. This means that the professional traders, although fewer than retail traders, control the liquidity of the market and are significantly linked to market movements.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.