Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

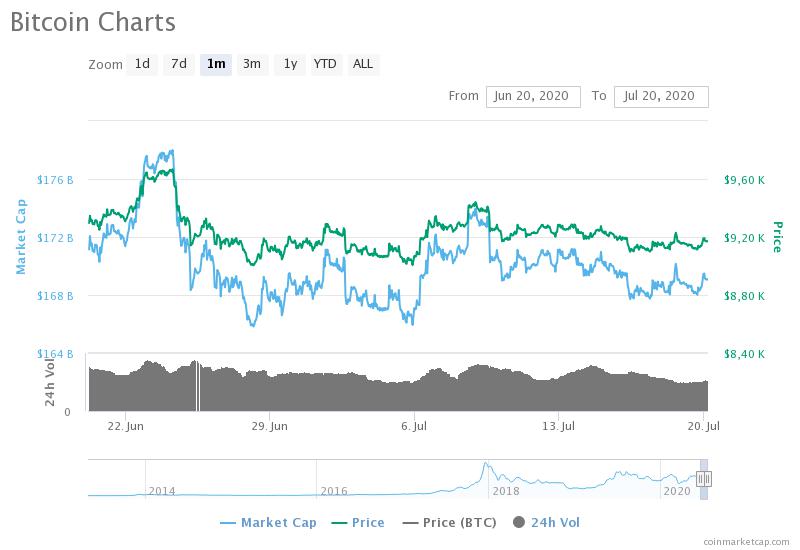

Over the past few months, despite COVID19 and the halving event, Bitcoin price has remained somewhat stable. With a $9 680,37 USD high over the last 30 days and a low of $8 975,53 USD, the cryptocurrency hasn’t broken in either direction, holding an approximate trading value in place fairly well.

Looking at the data, it’s clear that the token is tight between just below the $9,000 USD mark and $9,700 USD, with a steady graph hugging the resistance and support.

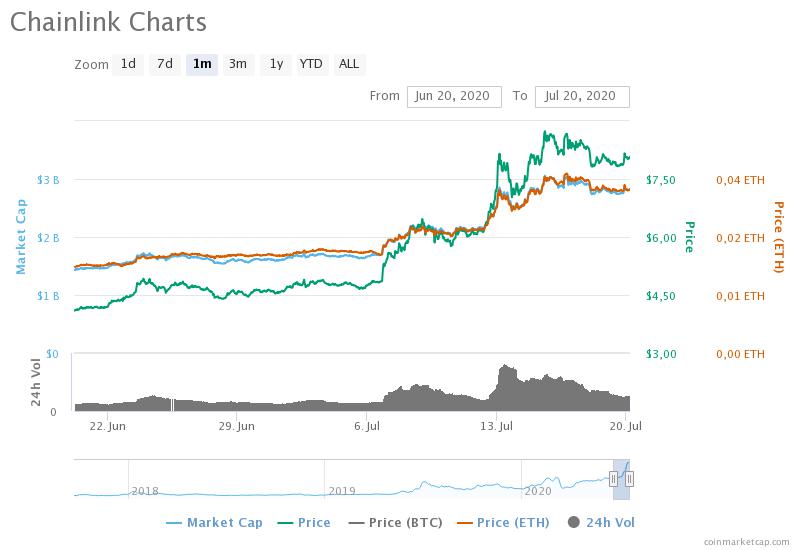

Chainlink (LINK) on the other hand, has been enjoying a massive upsurge in price over the past month. The altcoin recently broke its all-time-high to see a price tag of $8,80 USD, over double the value it held a month ago when it was trading at $4,15 USD.

This new push in value has sent Chainlink into the top ten traded tokens on CoinMarketCap, as it overtook Litecoin, EOS and Crypto.com Coin. At present, Chainlink is still trading in the green in daily trading, with a 2.16% increase. However, it’s uncertain whether the altcoin will see a second surge, continue to rally, or whether it will be facing a dip of traders decide to sell. Should this be the case, Chainklink’s surge might looking at a classic pump-and-dump situation.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.