Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

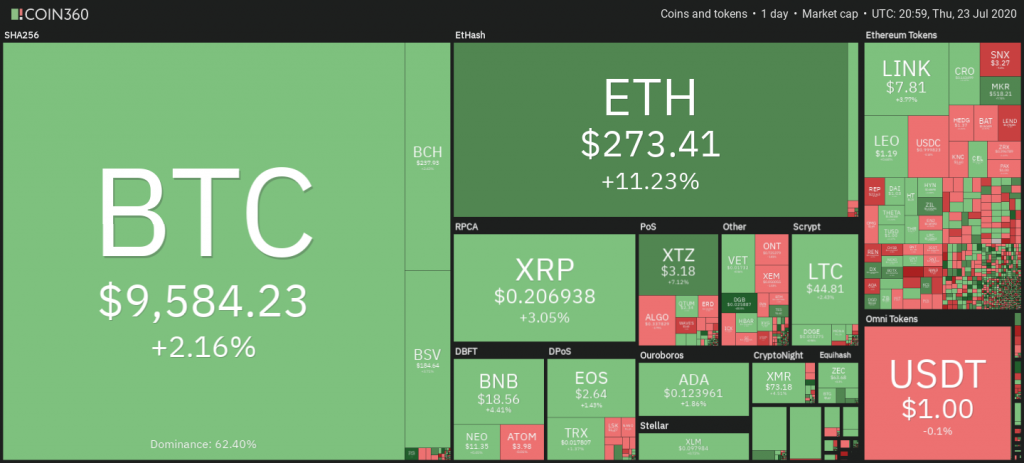

The cryptocurrency market is showing a flash of green, with Bitcoin and altcoins alike showing increases as the week comes to a close. Looking at data taken from Coin360, we can see that the majority of the leading cryptocurrencies are showing the positive price gains. This stands with the exception of stablecoin Tether which recently saw a major surge in market capitalisation, so a re-correction with a small dip is unsurprising.

Bitcoin has been fairly stable over the past few months, showing no signs of its characteristic volatility. Bitcoin price has been ranging between the support barrier around $8 900 USD and a resistance barrier around $9 680 USD for the past month without breaking in either direction. While Bitcoin still hasn’t broken the barrier, it did see a tidy increase over the week with a 5% jump in price on Tuesday. Since then, the price has seen a steady rise.

It’s possible that the reason for the spike this week is as a result of the announcement made by the Office of the Comptroller (OCC)of the Currency, declaring that United States banks can now provide cryptocurrency custody services. In an announcement shared with Cointelegraph, the OCC stated:

“The OCC recognizes that, as the financial markets become increasingly technological, there will likely be increasing need for banks and other service providers to leverage new technology and innovative ways to provide traditional services on behalf of customers.”

Brian Brooks, acting Comptroller of the Currency sees this as a necessary move to improve the traditional banking system in the United States, saying:

“From safe-deposit boxes to virtual vaults, we must ensure banks can meet the financial services needs of their customers today,”

The OCC further noted that the custody of cryptocurrency assets relies on their access to the keys, stating that “national banks may escrow encryption keys used in connection with digital certificates because a key escrow service is a functional equivalent to physical safekeeping.”

Ethereum, which often takes influence in trading trends from Bitcoin, saw a huge jump in price during the week, surging by over 10%. The leading altcoin’s lowing trading price over the week stands at $232,11 USD before spiking to its highest trading price at $277,58 USD, boasting almost a 20% difference in the range. Ethereum’s highest value this week also stands as the highest figure the cryptocurrency has reached in the past four months of trading. At the time of writing, Ethereum is looking at a 10,31% increase in daily trading values, possibly looking to continue up into the weekend.

There’s nothing specific to point to Ethereum’s recent spike in price at this time. However, given that the cryptocurrency market is often heavily driven by sentiment, it’s possible that the surge is a byproduct of Bitcoin’s price going up earlier this week.

Over the week, Chainlink has seen a massive rally, a small re-correction, and a continued increase in trading value. As reported on Monday, Chainlink saw a huge 100% increase in growth over the month, spiking from a trading price of $4,15 USD to an $8.80 USD price tag per token. That increase sent Chainlink to the top ten traded tokens according to CoinMarketCap. Since Monday, it has managed to maintain its position, holding the number nine spot of ranked cryptocurrencies.

At the time, it was uncertain whether the major spike would be a pump-and-dump scenario and that it would fall drastically in price soon thereafter. It seems as though this might not be the case, as the token continues upwards despite the small midweek wobble.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.