Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

After tagging an all-time high in November, Bitcoin has been struggling to hold above $40,000 USD, ranging between $36,000 USD and $44,000 USD in the past seven days. This might be a far cry from the value of just above $69,000 USD it experienced towards the end of 2021, with a 46% shed since then, but the bear market might not be as pessimistic as it looks.

Last week, the total cryptocurrency market cap fell below $2 trillion USD and we’re starting to see experts and analysts in the field suggesting that the industry is heading into the next bear market. The market has continued to struggle to hold strength in the past three months, with major holders and institutional taking major losses. MicroStrategy, spearheaded by prominent Bitcoin bull Michael Saylor, faced massive $146 million USD losses from the Bitcoin it has acquired.

Despite the declined values, a bear winter for the cryptocurrency market offers a chance for investors to buy Bitcoin at lower prices if they plan to hold cryptocurrency as a long-term asset. It also provides platforms the opportunity to work on improving the technology, and develop the industry beyond the price-tag. As the cryptocurrency market expands without the pressure of high trading prices, developers can work on sustainable projects that promote long-term value rather than short term trading.

Vitalik Buterin, founder and core developer of Ethereum, weighed in on the possibility of a crypto winter with Bloomberg, saying:

“The people who are deep into crypto, and especially building things, a lot of them welcome a bear market. They welcome the bear market because when there are these long periods of prices moving up by huge amounts like it does — it does obviously make a lot of people happy — but it does also tend to invite a lot of very short-term speculative attention. The winters are the time when a lot of those applications fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people.”

If the market is heading into a sustained cryptocurrency winter, projects will have enough time to focus on surviving and building sustainable technology before the time the next rally comes around. Experts in the field predict this might be according to historic cycles, which would take the bear run until 2024, sometime around the next Bitcoin halving.

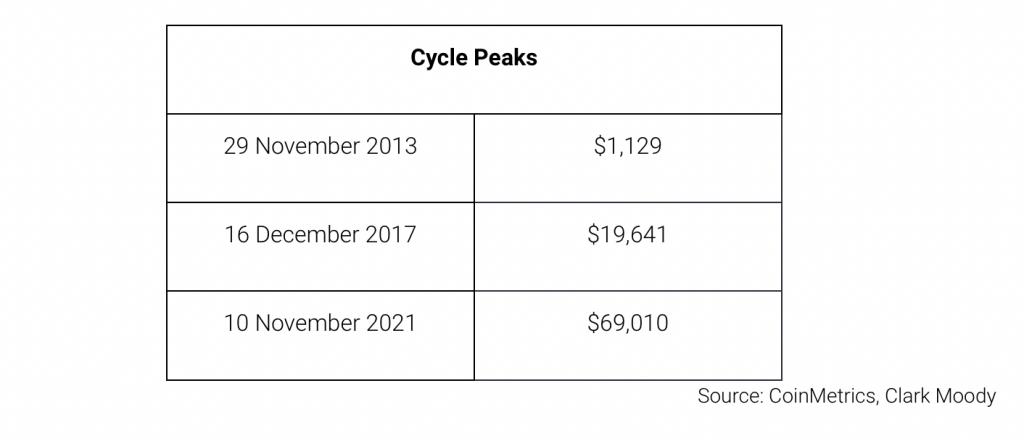

The previous Bitcoin cycle peaks occurred a few months after the Bitcoin halving. In 2020, Bitcoin saw major growth, increasing after a drop in value as a result of financial uncertainty related to the global pandemic.

The cryptocurrency winter in 2018 followed the massive bull run in 2017, where Bitcoin saw just under $20,000 USD. According to Huobi co-founder Du Jun, the cycles of bull rallies and bear runs are closely linked to the Bitcoin halving, as investors, miners and crypto devs experience the supply shift as the mining reward is halved. If this is the start of a new bear run, he predicts we’ll be looking at the next rally in 2024/2025:

“If this circle continues, we are now at the early stage of a bear market. Following this cycle, it won’t be until the end of 2024 to the beginning of 2025 that we can welcome the next bull market on Bitcoin.”

If this predictions comes to pass, it gives developers and projects two to three years to build and improve on the technology in the industry while the tokens price tries to find stability.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.