Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

As Bitcoin cracks above $40,000 USD, data confirms that the demand for the cryptocurrency is gaining on some significant fronts. According to research conducted by on-chain analysts firm CryptoQuant, institutional interest in the cryptocurrency market is increasing, indicating major positive sentiment from large-scale crypto investors.

According to Ki Young Ju, CEO of CryptoQuant, institutional buys into Bitcoin might just be the “big narrative” in the scene.

30k $BTC flowed out from Coinbase today.

Institutional buys might be the big narrative again because the Executive Order did not create any hurdle.

h/t @burak_tamac

Live Chart 👇https://t.co/3ZifmxFo1j pic.twitter.com/KjA7OpefMd

— Ki Young Ju 주기영 (@ki_young_ju) April 15, 2022

Looking at the figures from Coinbase Pro, the trading branch of leading cryptocurrency exchange Coinbase, a large number of institutional investors are buying Bitcoin from the platform. With 30,000 Bitcoin moving in a day from the trading platform, the crypto market is not showing signs of intrigue from high-profile investors. In March, Coinbase Pro saw similar outflows from the platform too.

According to data across echanges, overall outflows from exchanges is showing demand across the market. March saw an overall positive buying demand in crypto, and it seems April is set to match the month.

This comes at a time when the macroeconomy is putting pressure on investors to trade safely, as inflation increases and global tension shows no signs of decreasing. While cryptocurrencies might act as a hedge against struggling fiat economies, the asset class is seen as risk-on currently, which might be less appealing to general investors. As it stands, Bitcoin’s price trend remains fairly close to fintech assets and stock in innovative tech companies. The correlation has been growing for several months, but it might not remain linked, according to financial analyst Dylan LeClair.

– Rising yields

– Spiking volatility

– Nasdaq puking

– $BTC following in tandem2022 summarized. pic.twitter.com/1SsK8BBld0

— Dylan LeClair 🟠 (@DylanLeClair_) April 11, 2022

He commented that Bitcoin has been following Nasdaq’s direction, but continued.

“Correlation breaks eventually – for multiple reasons My guess: Eventually credit system breaks and volatility explodes. BTC follows but more because of deriv traders and not spot selling. BTC bears conditioned to fade every rally get rekt as spot supply continues to constrain.”

Over the past week, Bitcoin has held onto trading above $38,500 USD, looking at a low weekly value of $38,779.59 USD and reaching a high point at $41,522.57 USD. While this weekly high is still 40% off its all-time high value of $69,044.77 USD in November last year, the market is showing lower volatility and positive sentiment at the moment – indicating a sign of healthy gradual inclines.

Source: Coingecko

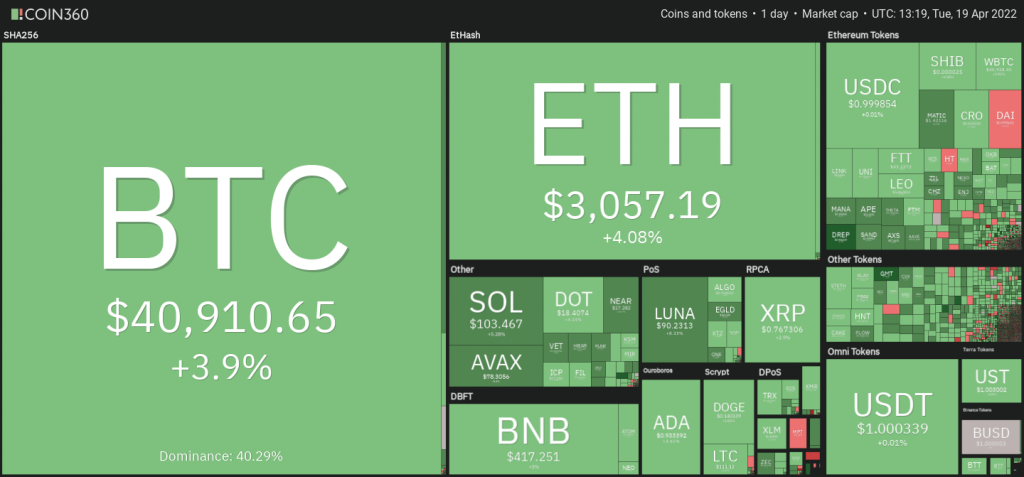

Currently, Bitcoin is holding a market dominance of just over 40%, with altcoins in the crypto space showing similar price trajectories as the leading token. As per Coin360, the cryptocurrency market is a flash of green as tokens are going into the middle of the week with modest to strong performances. Bitcoin is looking at a nearly 4% increase in day-on-day trading and leading altcoin Ethereum is bagging a 4.18% increase in daily trading value.

Source: Coin360

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.