Kate’s Data Breach Sparks Urgent Call for Enhanced Security Measures

After Kate Middleton's alleged data incident and possible internal attack at the London Clinic, there's a clear need for security in cyber...

While most Bitcoin traders enjoy the anonymous nature of cryptocurrency and like to keep quiet about their gains from investing and trading in the industry, others are raking in the millions – and letting the world know about it.

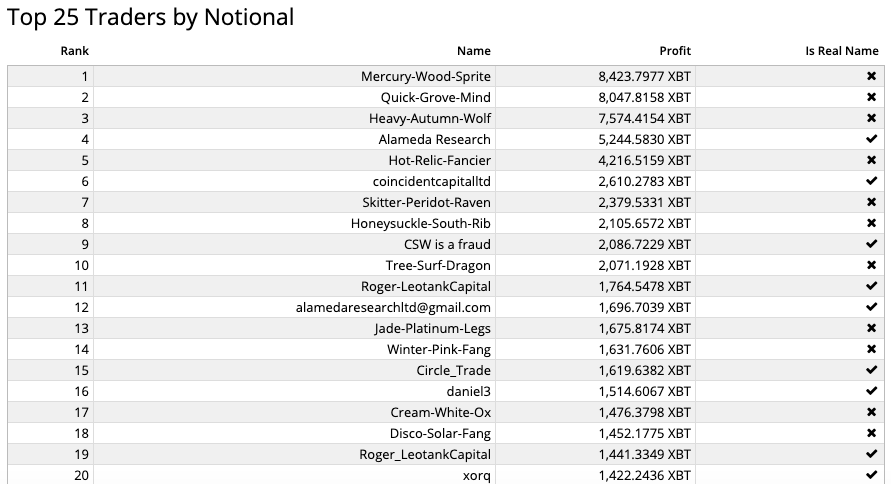

Alameda Research, for one, is boasting the firm’s trading activity. The firm, unlike most other investors who prefer to remain pseudonymous, is naming itself on a leaderboard on BitMex’s exchange. Taking positions 4 and 12 on BitMex’s top 25 traders, Alameda stands as the most profitable “named” entity on the exchange, bringing in an accumulated amount of over 6941 BTC with two accounts. This, at the time of press, weighs in at nearly $60 million USD.

27-year-old Sam Bankman-Fried, Alameda’s co-founder and chief executive officer, commented:

“It’s often very hard from the outside to have a good sense of who is doing things in crypto. One of the things about a leader board is, it’s actually quantifiable and verifiable. It’s something that made it stand out from other firms.”

Bankman-Fried explained that the firm has made its millions with a focus on Bitcoin arbitrage trading and other trading strategies. According to the firm’s co-founder, Alameda handles approximately $1 billion USD per day in trading, making up approximately 5% of the global Bitcoin trading volume.

Read more: What Is Bitcoin Arbitrage Trading?

Over the past two years, Bankman-Fried has been taking advantage of both simple and more sophisticated methods of arbitrage trading. Initially, the trader would sell Litecoin at a premium price at Coinbase after buying it through a different cryptocurrency exchange at a lower price. Now, the market has fewer simple trading opportunities available and automated trading and tracking systems are used to source low cryptocurrency sales to resell for elevated prices.

To set up automated systems to track crypto prices, Bankman-Fried recruited former classmates from the Massachusetts Institute of Technology (MIT), including fellow Almeda co-founder Gary Wang. The trader also makes use of insights from Wall Street investors. In order to protect assets and ensure security, the private company only hires friends or friends of friends. Over and above security at a personal level, the company also doesn’t make use of external capital and only trades Bitcoin using funds it has accumulated through the profitable trading.

Similar to trading forex, Bitcoin trading happens when investors buy and sell at a professional level on advanced exchanges This strategy relies on keeping consistently updated on the price of Bitcoin, as minor fluctuations can have major impacts when dealing with high amounts.

Cryptocurrency mining can happen at two levels: Solo mining or in mining pools, which is when solo miners join resources together to increase the power. Cryptocurrency mining now is extremely heavy on energy resources, and the power needed to mine Bitcoin blocks is expensive. This means the right assets are needed to pull a good profit money from Bitcoin mining.

Find out more: What is Bitcoin mining?

Some companies reward people in Bitcoin if they refer new customers. Many exchanges make use of affiliate programs with incentivised programmes, encouraging customers to share their services to further the reach of their audience and attract new potential traders.

After Kate Middleton's alleged data incident and possible internal attack at the London Clinic, there's a clear need for security in cyber...

Some scams are easy to see, but others might look like a worthwhile investment opportunity. Here are some crypto red flags to look out for.

A guide on how to buy Bitcoin using a credit card for first time users and steps to use when registering an account.

There are a few key differences between a spot Bitcoin ETFs and other Bitcoin ETFs in how they are structured and direct exposure to...