Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

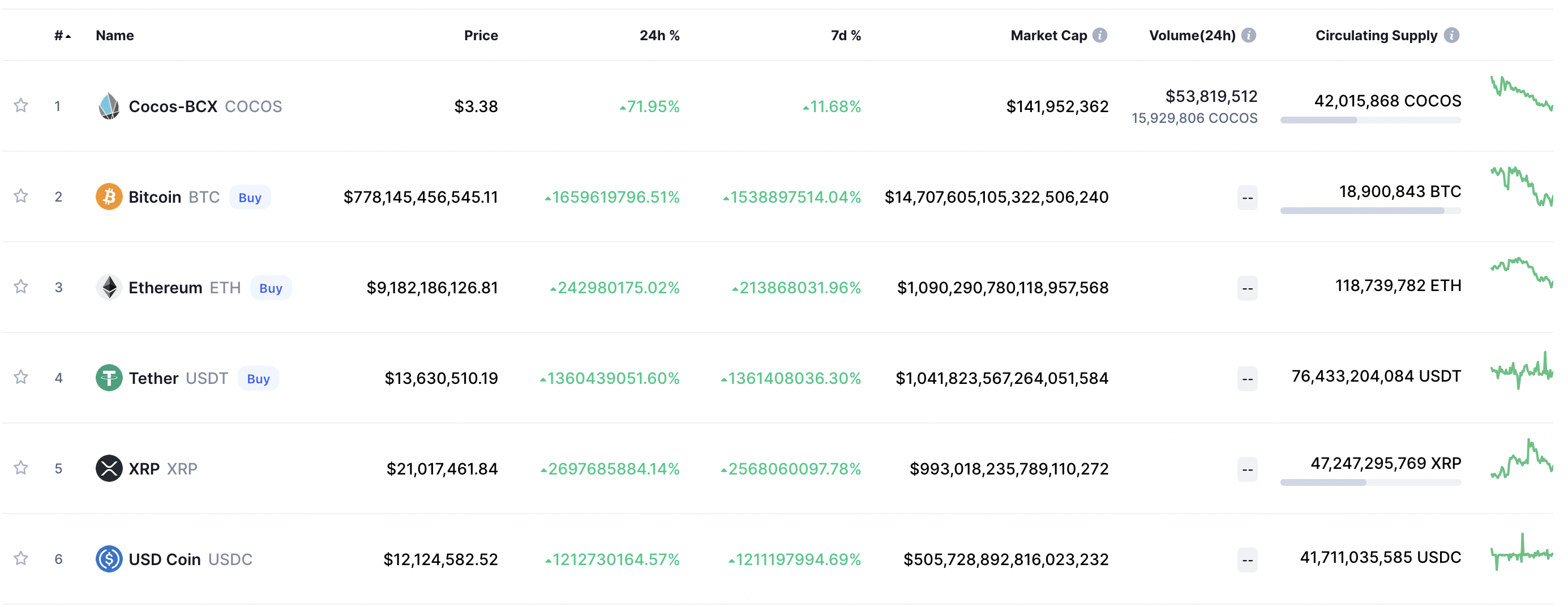

Earlier this week, crypto data aggregator CoinMarketCap was shoved into the limelight as the cryptocurrencies listed were showing astronomical prices, market caps and enormous trading volume. The prices seemed unseemingly – because they were. A bug in the system was the cause behind the massive price hikes but the impact went a little further than the glitch.

For an hour on Tuesday evening, CoinMarketCap – and other platforms that rely on the data of the aggregator – showed Bitcoin and other cryptocurrencies at prices at absurd prices that came out of nowhere. According to CoinMarketCap, Bitcoin’s market cap was around $14.7 quintillion.

As other platforms pull data from CoinMarketCap, the enormous values were seen across the market, not just in isolation to CoinMarketCap. Users of platforms like leading global crypto exchange Coinbase and decentralized finance (DeFi) protocol DeFiChain would have seen their holdings skyrocket to an unreal moon.

Unsurprisingly, the bug saw a wave of attention on social media. Individual platforms took to Twitter to explain the nature of the glitch, explaining that the massive prices were the result of a bug and that some features on their platforms had been suspended. DeFi explained that DeFiChain Vaults were automatically hated for the safety of the loans. As a decentralised platform, the halt brought the question of complete decentralisation to light. However, the halt came as part of a wired code on the protocol, not a single entity.

Due to an error with the @CoinMarketCap API, all DeFiChain Vaults have automatically been halted for now, ensuring the safety of your loans.

— DeFiChain (@defichain) December 14, 2021

Despite the explanation, users have expressed that they are not impressed by the use of CoinMarketCap API as the resource for data. Comments like “talk about amateur hour” and “How in the hell can anyone leave money in this project after seeing a tweet like this?” swept socials following the announcement from the protocol.

CoinMarketCap itself has seen a fair share of controversy when it was acquired by Binance last year, with critics pointing out elements of bias in exchange rankings. This came in spite of updates from the aggregator, saying that it would run independently from the exchange.

The aggregator made light of the situation, however, not everyone saw the humour in the situation.

How did it feel to be a trillionaire for a couple hours?😂

— CoinMarketCap (@CoinMarketCap) December 14, 2021

Crypto.com, which was also affected by the glitch was less than impressed by CoinMarketCap’s glitch and response to the situation, expressing that they were “already” removing CoinMarketCap’s data from their product.

You don’t have to tell us anything — we are already working on removing @CoinMarketCap’s unreliable price feed from our product.

— Kris | Crypto.com (@Kris_HK) December 15, 2021

As explained by Owen Lau, an analyst at Oppenheimer & Co, investors, customers, and users of platforms might not understand the glitch might not come from platforms themselves, and will not have tolerance for issues espcially where their funds are concerned:

“The perception here is it happens quite often to the level that people start to get impatient. While people are still looking for the root cause, I won’t be surprised to hear that people would blame the client facing app like Coinbase even if the problem comes from the data supplied by the third party.”

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.