Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

New data shows that there is an increasing number of ordinary individuals, not necessarily involved in the crypto scene or widely celebrated professions, taking out some of their salaries in cryptocurrency across the world.

Global hiring firm Deel published a report noting that there has been an increase of 10% month-over-month of people that are taking out their wages and salaries in cryptocurrency since the end of 2020. According to the report, people particularly in Latin America, the Middle East, and Africa are taking their paychecks out in crypto. Over 100,000 contracts across 150 countries were researched by the firm and 52% of those taking out their salaries in crypto comes from the Latin American region, 34% were from Middle East and Africa, 7% were from North America and 7% were from the Asia Pacific region.

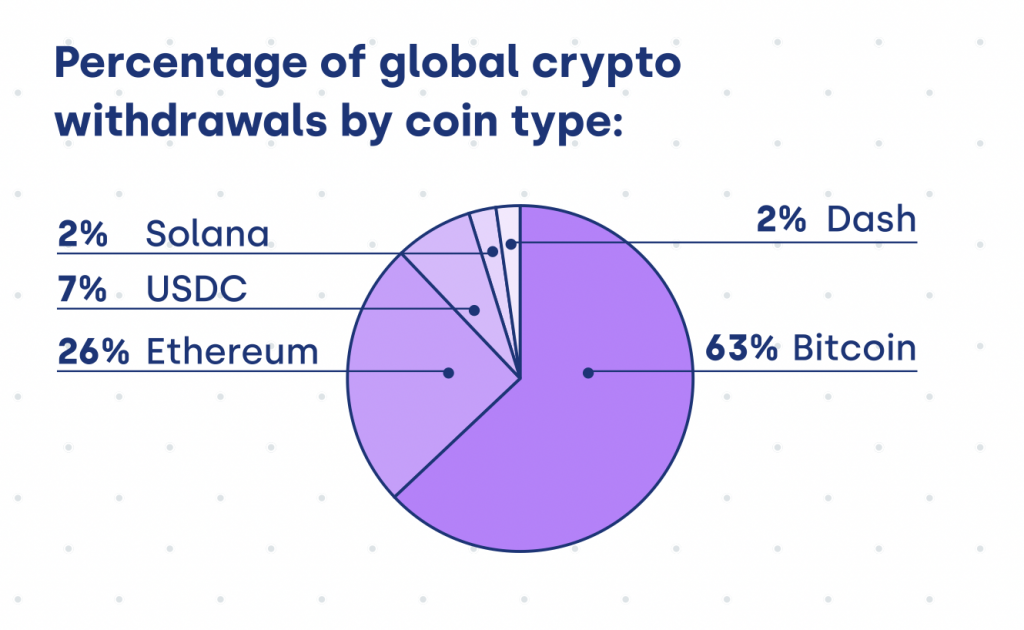

Notably, there has been an increase in cryptocurrencies taken as salaries in emerging markets compared to regions with established markets. As individuals in emerging markets are more likely to face high inflation, cryptocurrencies offer a hedge against the fiat economy, despite the inherent volality. Commonly, Bitcoin is the preferred token in the market, but altcoins are gaining traction. Bitcoin’s dominance sits at 63% of global crypto withdrawals with altcoin withdrawals increasing month-on-month with Ethereum (7%), USD Coin (7%), Solana (7%), and Dash (2%) gaining as preferred tokens.

Source: Deel

Following a few months of the crypto market struggling to find its strength after Bitcoin fell towards the end of 2021, there is caution related to how volatile taking crypto over traditional fiat tokens might be. While active traders and investors use the volatility of the market to make trades and profit from the market movements, taking cryptocurrency as a salary has its own set of risks.

I guess it would be interesting when you wake up the next morning after receiving your salary only to find out the market had dumped drastically and so has your salary cause it’s now in crypto what then ?

— Joey Jackson (@JoeyJackson112) February 23, 2022

Bitcoin and cryptocurrencies are being withdrawn as salaries and there is increased adoption as a process for paying wages for businesses. There is also an increased adoption of cryptocurrencies used to make payments across small and medium businesses in different industries in the world. According to data, customers are more likely to buy from a business with more payment options offered. At the beginning of the year, a report was released noting that 24% of small businesses in a VISA survey are planning to accept cryptocurrency payments for users looking to use digital cash for transacting. The greater adoption of digital currencies stood at a whopping 82% of small businesses saying they plan to increase digital payment options this year. As per the report:

“An overwhelming 82% of SMBs surveyed said they plan to accept some form of digital option in 2022 and 73% see accepting new forms of payments as fundamental to their business growth. Of those surveyed, 24% said they plan to accept digital currencies such as the cryptocurrency Bitcoin.”

The future of cryptocurrency payments might be spearheaded by small businesses, but large businesses are also recognising the potential importance of the digital currencies as a payment gateway. With more businesses opening up new avenues to accept payments, customers are opting to use the alternative methods of paying for their products and services; a stream that will translate into larger corporations. Currently, we’re seeing this trend in institutions using cryptocurrencies on their balance sheets.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.