Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

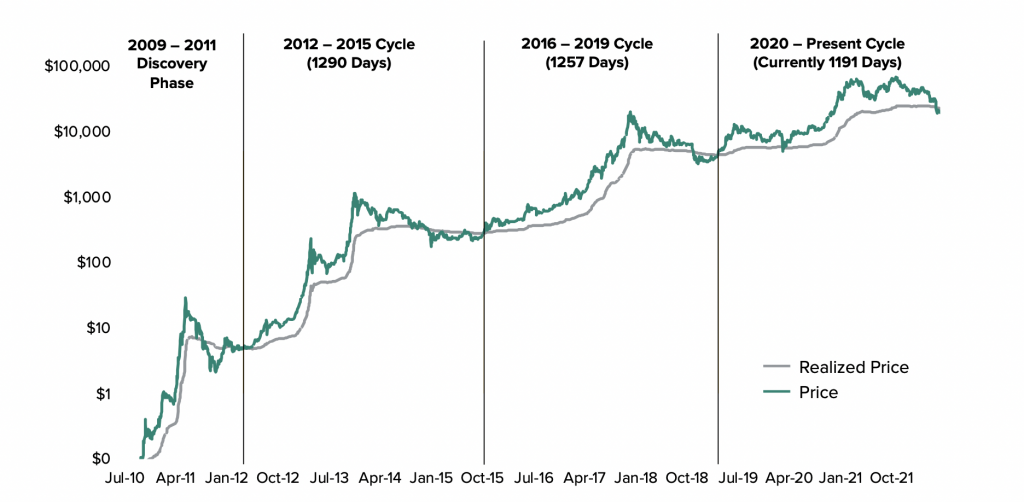

Grayscale Investment has released a fresh report, ‘Bear Markets in Perspective’, that looks at the current bear market – starting in June 2022 – and considers previous trends and cycles in the market.

According to Grayscale’s data, the current bear market could last another eight months (250 days) if the direction previous markets have gone in is anything to go by. Using historic trends, Grayscale points out that the cryptocurrency market tends to work in cyclical trends. As with the Bitcoin halving, which occurs around every four years, Bitcoin’s market cycle is around four years – or around 1,275 days. According to Grayscale, a cycle is defined by the movement of Bitcoin’s realised price going below the market price. Grayscale defines the realised price as “the sum of all assets at their purchase price or realized market capitalization, divided by the market capitalization of the asset which provides a measure of how many positions are in or out of profit.”

Source: Grayscale

Using Grayscale’s indicator, Bitcoin entered the bear run in mid-June. While a bear run makes the asset a riskier investment, the investment firm suggests in its report that a bear run could be the prime time to buy Bitcoin. “Buying the dip” and selling high is a common trading strategy, but when there is a prolonged winter or bear run, there is often a hesitation from investors to buy the asset.

Grayscale’s snapshot of the history of Bitcoin cycles would pin the current bear market to run from July for another 250 days if previous cycles repeat.

Looking at the 2012-2015 market cycle, we saw the first major bear market after the hack of the only prominent cryptocurrency exchange at the time Mt Gox. During the time, Bitcoin saw a flash sale, shedding 99% of its value within 24 hours. Following this bear market, Ethereum was launched and the market saw the entrance of new platforms and exchanges with increased security measures to protect themselves – and investors – from hackers.

From 2016 to 2019, the second cycle of Bitcoin’s life, there was an initial wave of adoption from investors other than those in the tech industry or early adopters. With the launch of Ethereum, many projects emerged leading to the ICO boom in 2018. Bitcoin saw a major crash, which critics referred to as the bubble bursting, after tagging its all-time high price.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.