Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

It can be difficult to know which basket to put one’s eggs into for long-term investment. With countless assets across the board, trying to settle on the right ones to add to a portfolio can be a tough decision, especially when analysts and experts have varying advice and opinions. One major decision is which type of asset to invest in. Crypto investment, which has been criticized – or in some cases lorded – for its volatility seems to be gaining more investor interest despite the early reputation of the crypto market.

According to new research conducted by CivicScience, a consumer data aggregator, more and more investors are shedding their shares to open up funds for cryptocurrency investment. The survey by CivicScience took the results from up to 40,600 respondents (depending on the question) to digest whether they would opt for stocks or cryptocurrency.

As per the results, those who said they were more likely to buy a cryptocurrency for investment compared to traditional stocks have exploded over the past six months, growing from 10% to 24%. Those who answered that they would prefer shares decreased from 90% to 76%. This number highlights how appealing cryptocurrency investment is becoming to new investors, as well as old investors, who have confirmed that they have sold shares to move their assets to crypto investment.

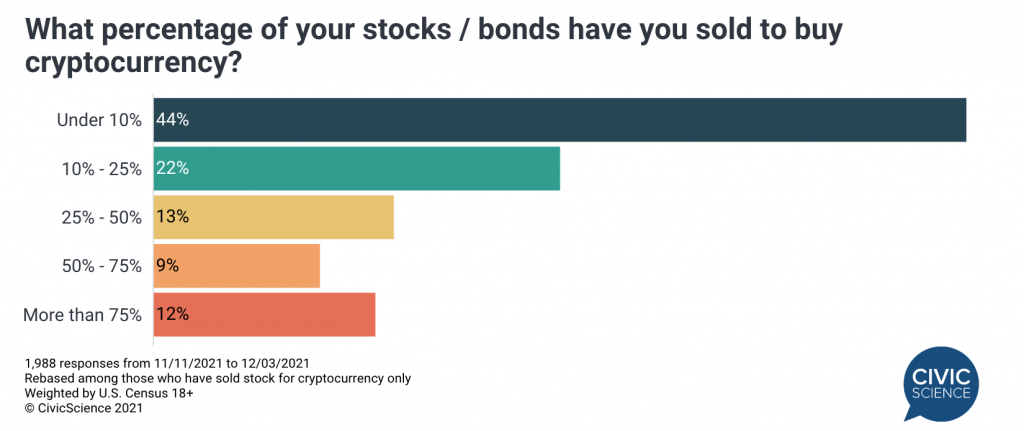

Diving deeper into buying cryptocurrency from previous investments, the data shows that more than 21% of investors have sold more than half of their assets tied into shares to buy cryptocurrency.

Source: CivicScience

Those who have sold their shares are those who follow financial and economic markets “very closely” or “somewhat closely”, per Civic’s research. This implies that those who are selling shares to buy cryptocurrency are not new to either market and are banking their bets on digital assets continuing the growth trend that they’ve been following. Of the over 1200 respondents who follow the market very closely, a massive 40% have said that they or a fellow investor have sold stock to buy crypto. Only 17% of those who don’t follow markets closely or at all have sold their shares or bonds for crypto assets.

Source: CivicScience

The data also took high-end celebrity influence over the market into consideration, looking at whether figures like Elon Musk and Warren Buffet might sway the market. According to the results, over the past six months, those “very concerned” about their influence on the volatility have decreased from 54% to 51%. Those “somewhat concerned” moved from 26% to 31% while those “not at all concerned” dropped from 21% to 18%.

This shows that volatility might still be an underlying concern for investors in the market, but not enough to discourage investors from buying cryptocurrency to invest as a long-term asset.

It’s worthwhile noting that this data also comes after the global pandemic rocked the world’s economy and aligns with how many countries are exploring the opportunity of digital assets. As more investors are looking to explore digital investment, and as more countries are leaning to implement blockchain-based assets with traditional finance, we’re looking at the beginning of a possible mass adoption in a way the market has never experienced.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.