Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

The idea of a digital currency has been around for over a decade, with Bitcoin paving the way for blockchain-based tender to exist in our financial system. However, the idea of a national digital currency set to work in conjunction with traditional fiat is slightly newer – and countries are excited to test it out.

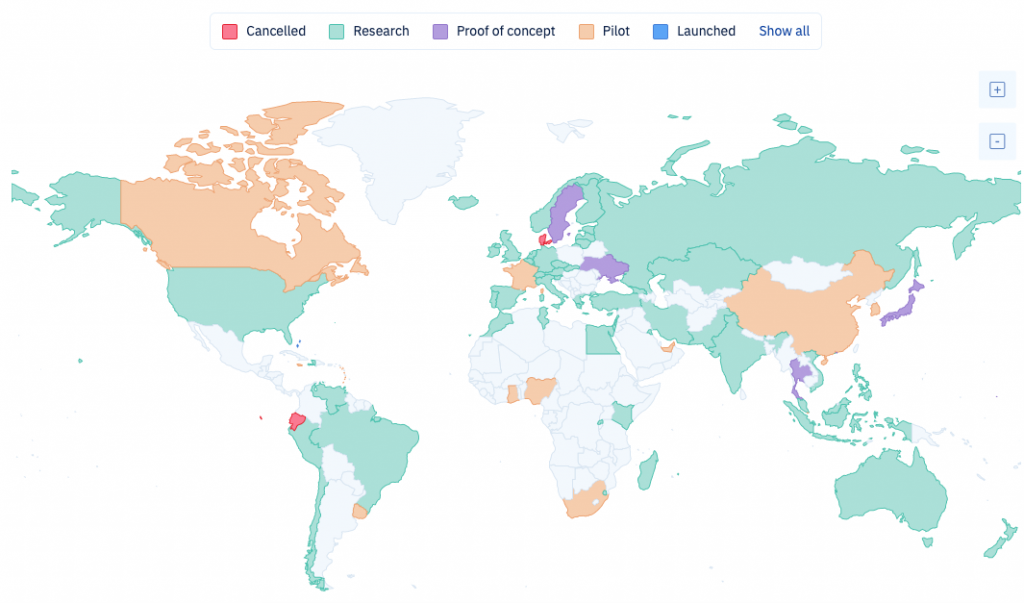

According to International Monetary Fund (IMF) director Kristalina Georgieva, more than half of all of the global central banks are exploring how a digital currency could be launched in their country.

At a virtual conference hosted by Milan-based Bocconi University, Georgieva noted that the IMF has been looking at how the implementation of national CBDCs across the globe might impact aspects within the macroeconomy and whether harnessing the technology is sustainable for the world’s economy. She stated that blockchain-based currencies offer people and countries the ability to tap into more affordable and smoother transfers and transactions. As it stands, Georgieva believes that CBDCs should be touted as the best option and most reliable form of digital currency (compared to other decentralised cryptocurrencies) as a result of the inherent regulatory compliance that is built into the concept.

Georgieva stated that over half of the world’s 195 independent countries are in some form of researching, exploring and testing a CBDC in their country:

“We did a survey of our membership, and it was very impressive: 110 countries are at some stage of looking into CBDCs.”

In the conference, Georgieva continued to add that stablecoins and digital currencies issued by a central bank are able to bridge the gap between traditional finance and privately issued money. However, she noted that Bitcoin and other decentralised cryptocurrencies offer the resources for asset and investment, rather than money. With volatility and a lack of regulation – and therefore state and public trust – Bitcoin is ill-fitted as a substitute for money as tender.

She also noted that well established legal framework is a necessity for central bank digital currencies to work and function in an economy.

According to CBDC Tracker, the majority of the countries exploring CBDCs are in the northern hemisphere. This comes despite expert’s claiming that developing countries or emerging markets would benefit from a digital currency to ‘bank the unbanked’.

There are only five of the countries that have explored central bank digital currencies and decided to scrap the idea. Tunisia, Haiti, Denmark, Ecuador, and Finland for various reasons have cancelled the concept.

Source: CBDC Tracker

Right now, the Bahamas is the only country with a CBDC that is backed by the state. The Sand Dollar was launched by the Central Bank of the Bahamas in 2020. There are four other central banks in the world that have launched a CBDC, but not as state-backed digital currencies.

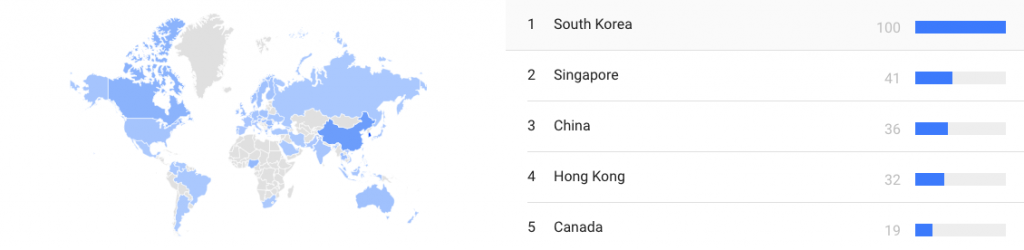

Meanwhile, the interest in CBDCs across the world is mostly across the Asian market. According to Google Trends, the majority of search interest comes from South Korea, which is currently piloting a CBDC. Singapore, China, Hong Kong and Canada are in all various phases of testing their own CBDCs. In some cases, there are two or more CBDCs currently researched and tested in a country. Canada, for example, is researching the e-dollar while piloting Jasper which is a collaborative project between Payments Canada, the Bank of Canada and other market participants.

Source: Google Trends

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.