Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

Bitcoin and other cryptocurrencies in the market are currently spiking, with the leading token trading nearly 8% higher in daily trading, after news came in that United States Joe Biden announced an executive order on digital currencies.

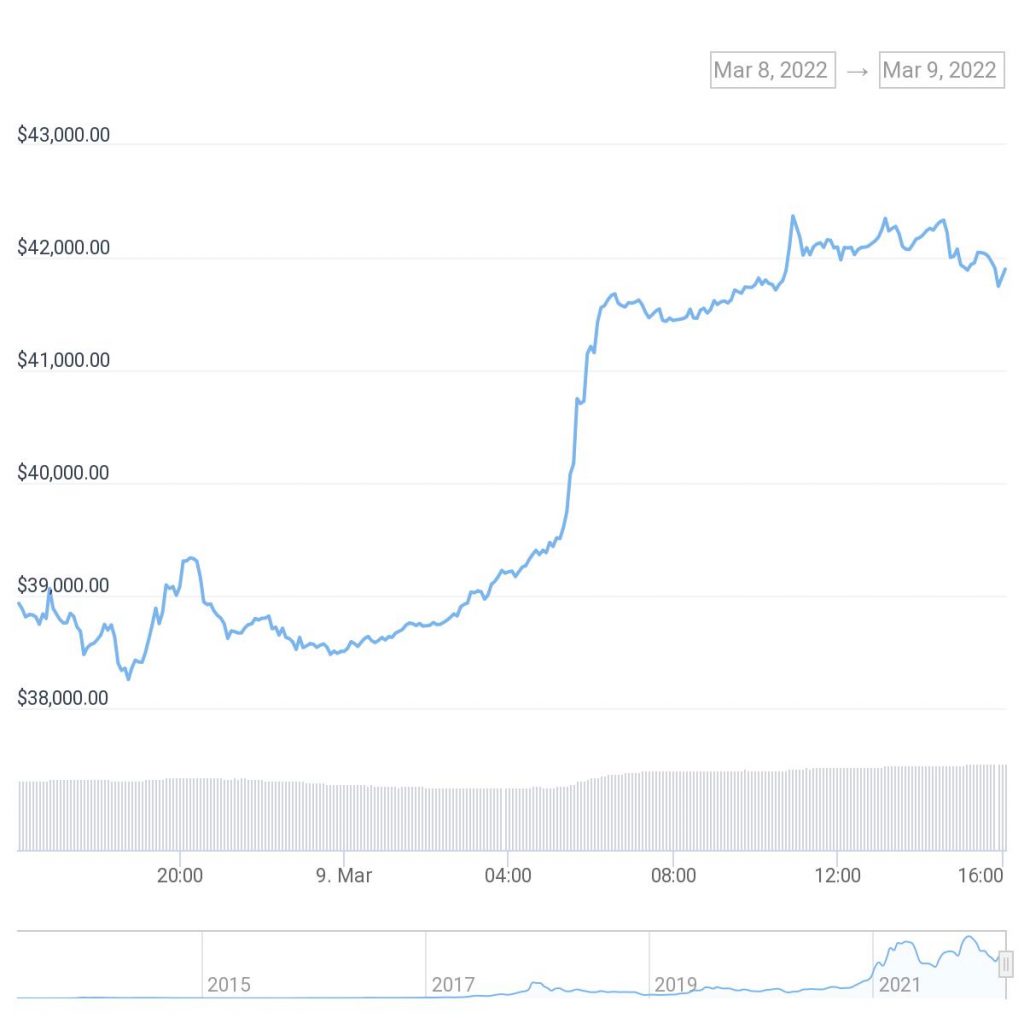

Looking at the market over the past day, Bitcoin has risen from a low trading value of $38,255.20 USD, shooting up by 7.6% to hit $42,370.54 USD.

Source: Coingecko

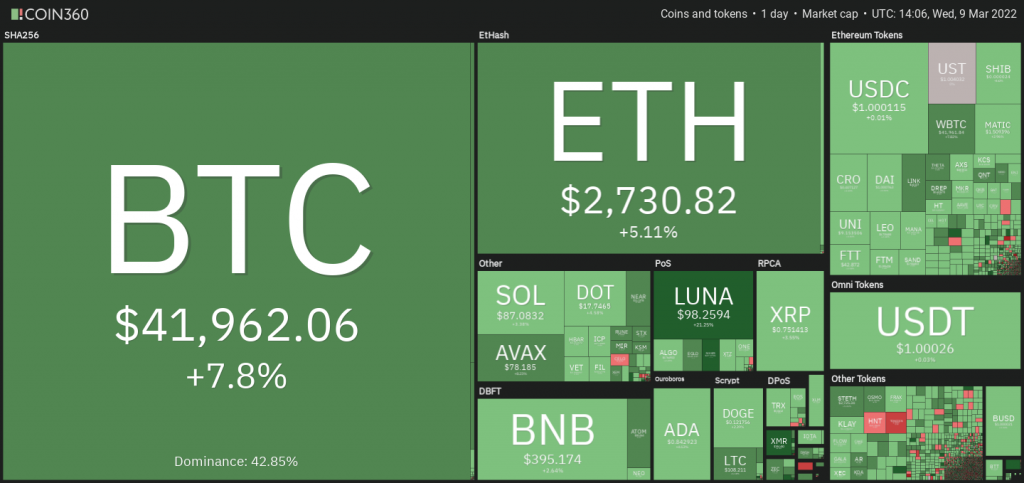

Beyond Bitcoin, the rest of the cryptocurrency market is a flash of green, too with leading altcoin Ethereum looking at a 4.9% increase in daily trading volume. It saw a low of $2,534.47 USD in the past 24 hours to a current high of $2,763.55 USD. In the top ten traded tokens, Terra has seen the biggest gains with a massive 21.6% increase in daily trading values, from a low of $80.13 USD to see a current 24 high of $99.60 USD, just 5.3% lower than its all-time high of $103.34 USD.

Data from Coin360 shows the wave of positive increases across the market in the past day, with Bitcoin dominance at 42.85% and a green industry mostly throughout.

The initial rise in cryptocurrency values across the market came just before the executive order announcement, starting on Tuesday evening. The statement from the United States Treasury Secretary Janet Yellen was leaked shortly afterwards and then published officially again on Wednesday, trajecting a further increase in the market.

According to the United States news, Biden’s order will put protocols and systems in place to address the current lack of digital finance infrastructure in the United States. It has been said by critics and analysts that the US is lagging behind the rest of the world regarding the digital currency industry – an issue Biden’s order seems to intend to rectify. As per the order:

“President Biden’s historic executive order calls for a coordinated and comprehensive approach to digital asset policy. This approach will support responsible innovation that could result in substantial benefits for the nation, consumers, and businesses. It will also address risks related to illicit finance, protecting consumers and investors, and preventing threats to the financial system and broader economy.”

The order, accidentally leaked a day early, noted that the government’s Treasury will work to promote a more efficient solution in the financial system while maintaining security and protection of investors and citizens:

“Treasury will work to promote a fairer, more inclusive, and more efficient financial system, while building on our ongoing work to counter illicit finance, and prevent risks to financial stability and national security.”

The order has placed a focus on six key areas of the government’s involvement in the cryptocurrency and digital asset industry, namely:

The executive order, directing the government to explore the development of technological infrastructure for digital currencies, has been met with positivity in the cryptocurrency community. As a comment on the need for digital currencies, industry experts and investors support innovation that will promote cryptocurrencies in the nation as well as a systematic approach to regulate the market in a way that digital currencies can thrive.

Gemini’s Cameron Winklevoss commented on the order, adding that he “[applauds] this constructive approach to thoughtful crypto regulation and look forward to working together with the various stakeholders to ensure that the US remains a leader in crypto.”

.@SecYellen‘s statement on @POTUS‘s executive order on crypto was apparently posted early. Based on remarks, crypto EO is positive and calls for “coordinated and comprehensive approach to digital asset policy” that “will support responsible innovation.”https://t.co/Z1URnWGzMu

— Cameron Winklevoss (@cameron) March 9, 2022

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.