Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

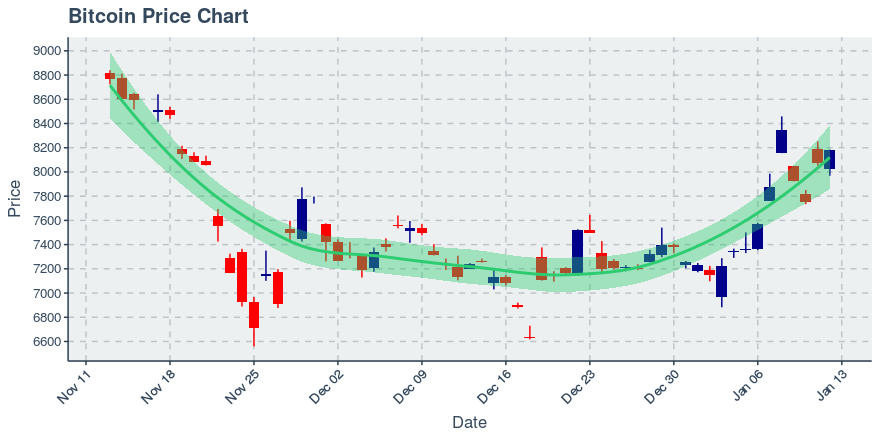

Bitcoin is up about 1.32% from the previous day, putting its price at $8,181.49 US dollars at the time of this writing. This marks the 2nd day in a row that Bitcoin has been up, and the coin is trending up. Since it is somewhat close above relative to its 20-day average price of $7,510.159, a fall down to the 20-day moving average may draw dip buyers in. On the flip side, for those who prefer a rangebound view when trading, Bitcoin’s trading range — based on its momentum and volatility over the past two weeks — is between $6,707.5 and $8,312.82 (in US dollars). The currency’s market cap is now at $147.06 billion US dollars, and its market dominance — the percent of the entire amount of capital invested in cryptocurrencies that belong to Bitcoin — is at 68.25%. Bitcoin’s dominance level has been without a clear trend over the past two weeks, fluctuating between 67.6% and 69.22%. A dominance level without a clear trend suggests that it may still be unclear as to whether or not we will live in a world with many viable coins, or whether Bitcoin will be the “one coin to rule them all”.

Technical analysis of Bitcoin for traders, plus the best of Bitcoin Twitter. Get it daily at CFDTrading.com.

283,136 transactions were added to the Bitcoin blockchain in the previous day. The trend in daily transactions is not clear, though it should be noted that transactions have jumped by about 7.27% over the past week. If Bitcoin does repeatedly grow transactions, it may need to derive its value as money for buying certain goods/services. As for Bitcoin’s transaction fees, the average transaction fee yesterday was $0.48 US dollars. Transaction fees have been falling by approximately 3.97% per week, while the average transaction size is down 9.02% in US dollars. Regarding Bitcoin’s hash rate, which serves as a measure of the network’s computational power, it has managed to trend upwards over the past 30 days. It has been rising daily by a rate of approximately 0.58%. A trend in hash rate that upwards suggests that mining is becoming more computationally difficult and that the chain is thus improving. As such, this might enable Bitcoin to draw more capital to its chain.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.