Bitcoin Halving Impact Fades as Demand Takes Center Stage

According to reports, the Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

Long-term Bitcoin holding hits an all-time high, with data revealing that the amount of the cryptocurrency that hasn’t moved for at least five years is higher than it has been before.

According to on-chain analytics firm Glassnode, the Bitcoin supply that has not been traded, sold, or moved for at least five years has hit a record high of just under 25%. This means around 4.78 million BTC of the 19.12 million BTC that has been mined and is now in supply has been off the market since 2017.

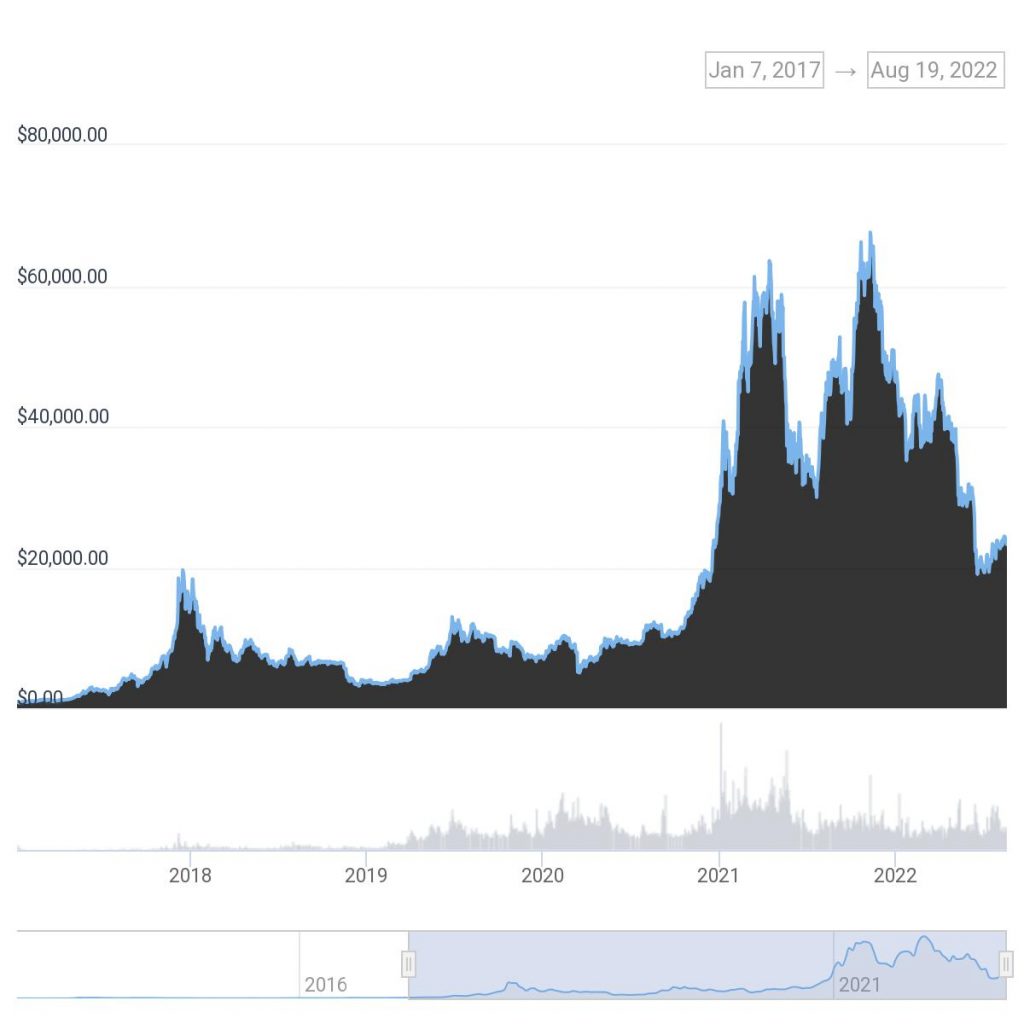

In the past two years, Bitcoin has managed to gain back over $5,000 USD since its lows seen in June. While it’s still looking at 66% off its record high, the current value also represents 10 times the price it held in 2017. The road has seen two bull rallies and significant price spikes and dips, but long-term traders seem to be increasing their holding time.

Chart: Coingecko

The last few months have seen their fair share of selling, with firms and institutions getting rid of their holdings during the bear run. From data collected coupled with market sentiment, this appears to be short-term market entrants and longer-term holders are not looking to sell their holdings.

Other data confirms this too, pointing out that Bitcoin activity is at a low point which traders not moving their tokens more and more. According to developer Tamas Blummer, Bitcoin’s activity tends to increase when holding decreases and the reverse. This means that when investors are accumulating and holding, the activity decreases:

“It is apparent that Liveliness (activity) increases (and HODL decreases) during time periods of Bitcoin price increases and investors accumulate to HODL during periods of range bound prices.”

According to Glassnode, the Bitcoin activity (Liveliness) is at the lowest the market has experienced in over a year and a half as investors and traders look to hold.

According to reports, the Open Interest in Bitcoin is now 30 times higher than it was 11 days before the 2020 Bitcoin halving.

Monero users' balances on Kraken after the deadline will have their coins automatically converted into Bitcoin.

Crypto.com has received full operational approval from Dubai’s VARA, becoming the first permitted exchange in the UAE.

Nigerian court rejected Binance executive Tigran Gambaryan’s defence argument and ruled that he acted as the exchange’s representative.