Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

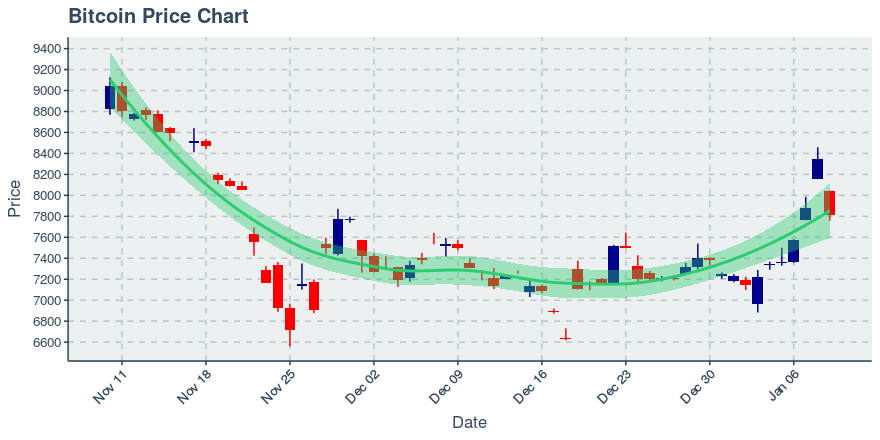

Bitcoin is down about 6.35% from the previous day, putting its price at $7,817.35 US dollars at the time of this writing. The past 24 hours mark a reversal in price from the day prior. It should be noted, though, that price is still in an uptrend, and is currently 5.45% above its 20-day moving average; staying above this level may be critical to sustaining short-term momentum. On the flip side, for those who prefer a rangebound view when trading, Bitcoin’s trading range — based on its momentum and volatility over the past two weeks — is between $6,740.72 and $8,086.31 (in US dollars). The currency’s market cap is now at $140.73 billion US dollars, and its market dominance — the percent of the entire amount of capital invested in cryptocurrencies that belong to Bitcoin — is at 68.69%. As for the recent behaviour, Bitcoin’s dominance level hasn’t exhibited a clear trend — but has fluctuated between 67.6% and 69.22%. As its dominance level doesn’t have a clear direction at the moment, one could argue it isn’t clear yet whether altcoins will survive — or if Bitcoin will capture the entire market and the vast majority of use cases for cryptocurrencies.

Want to trade Bitcoin Consider the following brokers: CoinDirect, Gate, Yobit, Stex, Binance, DDEX

322,057 transactions were added to the Bitcoin blockchain in the previous day. The trend in daily transactions is not clear, though it should be noted that transactions have grown by about 5.28% over the past week. Ultimately, if the currency does regularly succeed in growing transactions on its chain, its primary utility may be as money for buying certain goods/services. As for Bitcoin’s transaction fees, the average transaction fee yesterday was $0.48 US dollars. The size of the typical transaction on Bitcoin’s blockchain is down 9.02% in US dollars; meanwhile, the fee for sending transactions has been declining by 3.97% per week. Regarding Bitcoin’s hash rate, which serves as a measure of the network’s computational power, it has managed to trend upwards over the past 30 days. It has been growing daily by a rate of approximately 0.66%. Given the upward trend in bitcoin mining, it may be that hash rate is getting more intensive; this could result in the chain’s security growing stronger. This may help Bitcoin attract more high-value transactions.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.