Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

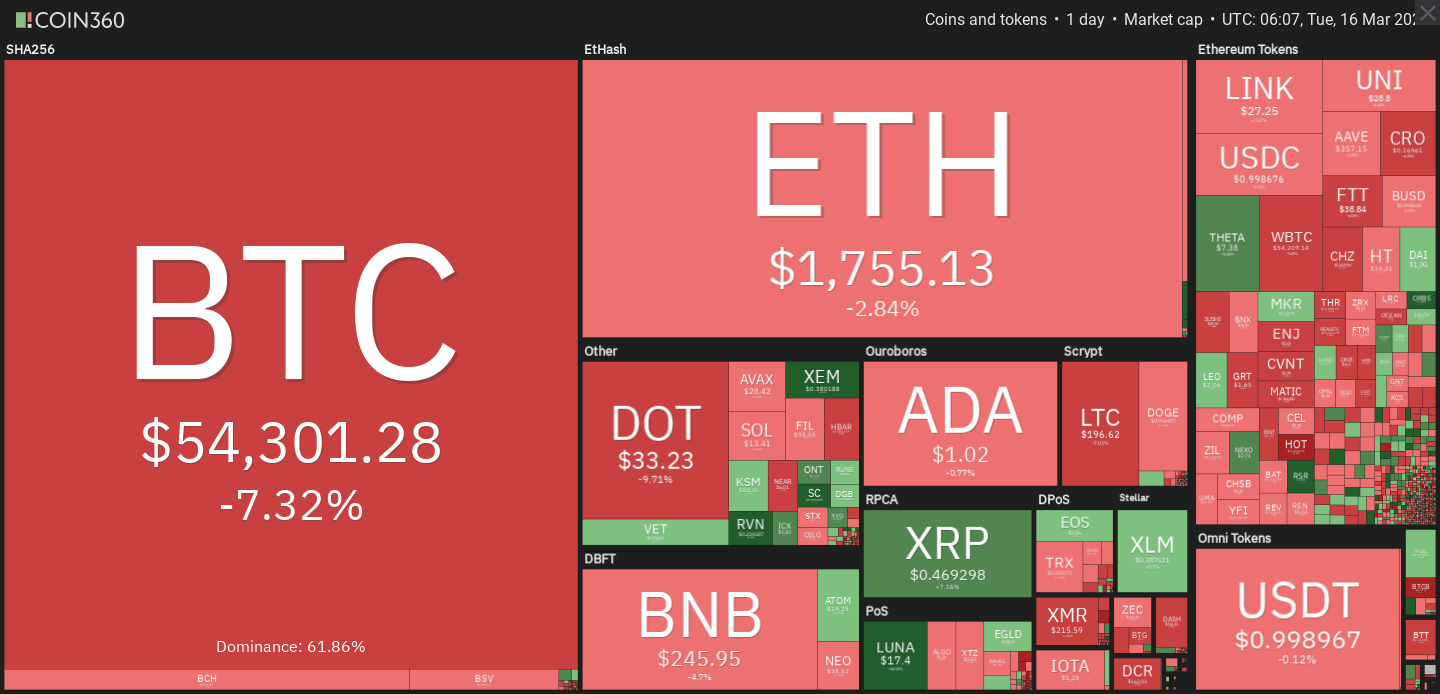

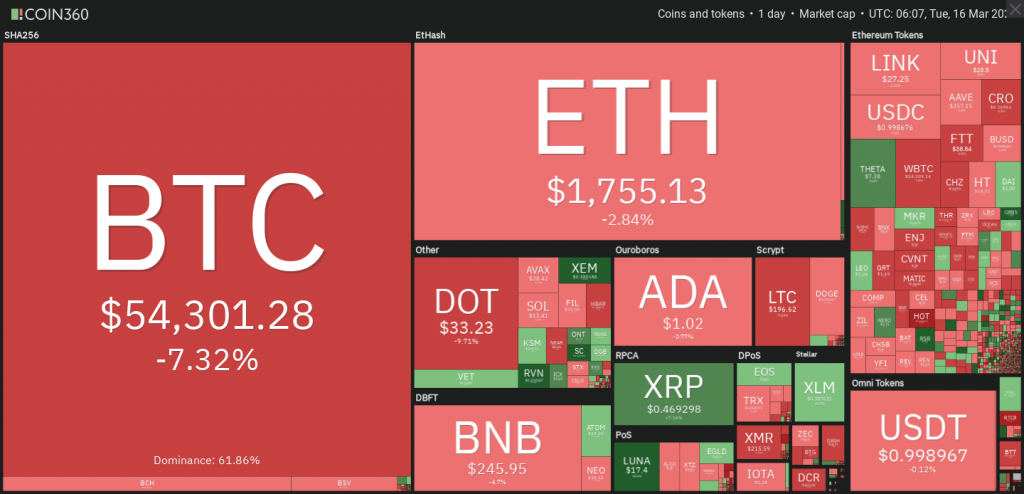

After tagging over $60,000 USD and seeming to break through the barrier of resistance, the Bitcoin market has rejected the mark and fallen by over 7% in the past 24 hours to below $55,000 USD.

The overall cryptocurrency market has taken a knock as a result of the rejection, with most tokens showing red.

Source: Coin360

According to Glassnode founders, the fall was a result of record-high Bitcoin liquidation with more than $500 million USD with of ling liquidation occurring in just over an hour’s trading. As noted by Jan & Yann, more than half of the open future contracts were leverages by more than 20 times prior to the margin calls.

In the last hour alone, nearly $500M in #Bitcoin Longs got liquidated, this is a historic ATH.

There is excess greed in the system, with 60% of contracts levered 20x or more.

Long liquidations are an artifact of the current bull market. pic.twitter.com/n9NciJcS62

— Jan & Yann (@Negentropic_) March 15, 2021

Conflicting data from Bybt points that more than $800 USD was liquidated in under 15 minutes.

Over $800m worth of long positions get liquidated within a 15 min timeframe.

data: @bybt_com pic.twitter.com/AfNzVEGqmW

— unfolded. (@cryptounfolded) March 15, 2021

Whatever the case, it’s obvious that Bitcoin took a knock from investors taking profit from their cryptocurrency holdings.

Datamish insights show that nearly 300 positions worth nearly $95 million USD were liquidated on BitMEX. At the same time, nearly 490 positions were liquidated for almost $100 million USD on Bitfinex. This amounts to the largest liquidation in Bitcoin history. Earlier this year, the second-largest day had made history when Bitcoin crashed from its all-time high of $58,300 USD to nearly $9,000 USD less at a trading value of around $47,000 USD. During this crash, nearly $6 billion USD worth of futures contracts were liquidated.

While a crash in price doesn’t always look optimistic, it’s worthwhile looking at the strength gained since the previous correction. If Bitcoin can hold its price before seeing a recovery, we might see a new all-time high in the next few weeks.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.