Hong Kong ETFs Open to RMB Investors: New Investment Opportunities

Hong Kong launched new crypto ETFs, and fund issuers hope this will open the door for mainland Chinese investment in the future.

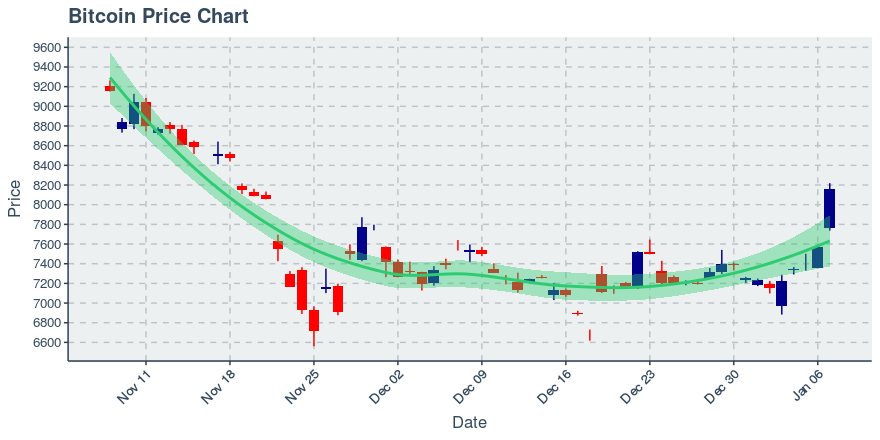

Bitcoin is up about 7.76% from the previous day, putting its price at $8,160.36 US dollars at the time of this writing. This is now the 5th straight day that Bitcoin has headed up, and the coin’s prevailing trend over the past 14 days is up. As price is currently somewhat far above its 20-day average price of $7,332.413, we may interpret that to mean as such, dip buyers may need to wait a bit more for an opportunity. On the other hand, if you are a rangebound trader seeking a range for Bitcoin to bounce between, you might find a lower boundary at $6,819.92 USD and an upper boundary at $7,844.91 USD. The currency’s market cap is now at $142.46 billion US dollars, and it’s market dominance — the percent of the entire amount of capital invested in cryptocurrencies that belong to Bitcoin — is at 68.22%. Bitcoin’s dominance has been trending down slowly, averaging a decline of -0.11% each day over the past two weeks. A decline in dominance may suggest a growing opportunity for investing in other coins, and as such, altcoins may constitute viable investment opportunities.

Want to trade Bitcoin Consider the following brokers: CoinDirect, Gate, Yobit, Stex, Binance, DDEX

344,079 transactions were added to the Bitcoin blockchain in the previous day. Daily transactions recorded on the Bitcoin blockchain grown by approximately 1.11% this past week, though it should be noted the trend is not clear at this time. If Bitcoin does repeatedly grow transactions, it may need to derive its value as a money for buying certain goods/services. In terms of transaction fees, the average cost for sending Bitcoin yesterday ended up being approximately $0.48 US dollars. The size of the typical transaction on Bitcoin’s blockchain is down 9.02% in US dollars; meanwhile, the fee for sending transactions has been falling by 3.97% per week. In terms of how much computing power Bitcoin is using, over the past 30 days its hash rate has continued to trend upwards, ultimately gaining daily by approximately 0.59%. Given the upward trend in bitcoin mining, it may be that hash rate is getting more competitive; this could result in the chain’s security growing stronger. From this perspective, this behaviour may provide Bitcoin with the ability to attract more high-value transactions.

Hong Kong launched new crypto ETFs, and fund issuers hope this will open the door for mainland Chinese investment in the future.

According to report a solo miner netted around $200,000 in rewards for validating a Bitcoin block 841,286.

President Jack Collison announced its re-entry in the crypto sphere, where Stripe users will be able to pay with USDC beginning this...

S&P Global shared a research proposal introduced to the Senate outlining Payment Stablecoin Act that could encourage banks in the US.