Unveiling Telegram’s Discreet Crypto Integration

Telegram revealed that many users will interface with cryptocurrency for the first time and not even notice it.

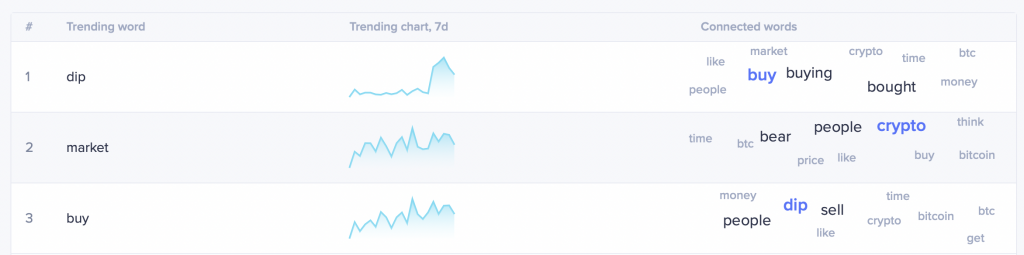

Cryptocurrency is trending on social media, going by the key words that have been focused on in the past seven days according to market data aggregator Sentiment. Furthermore, if the trending words are painting a picture, it’s one of purchasing cryptocurrency while the price sits dipped; following news that the Federal Reserve is cautious of crypto.

Over the past week, the word “sell” fell off the list of the top ten trending topics, and “dip”, “buy” and “fed” took the stage. Despite Bitcoin’s over 10% drop in the past seven days, panic selling might have cooled down and savvy investors might be looking to fill the gap and “buy” the “dip”.

Source: Santiment

Currently, according to the Crypto Fear and Greed Index, crypto sentiment is sitting at a score of 18, indicating “extreme fear” in the market. The past two days have also shown extreme fear. A week ago, the index read a score of 28, “fear”.

Crypto Fear & Greed Index, Source: alternative

In accordance with the index, some traders are concerned that the price of Bitcoin will plunge to a value as low as $30,000 USD – less than half of the trading value when Bitcoin reached its all time high in November. Crypto Ed, a popular crypto analyst on Twitter, noted that Bitcoin might go as low as September’s weakest values.

#BTC filling the EW puzzle.

Not there yet imo.

Lowered the potential bounce area because of weak bounce yesterday.

Could even go lower with a liquidation wick, below September lows….In case we break september lows and weak bounce, pic 2 is the risk. pic.twitter.com/FklxPhPelN

— Crypto_Ed_NL (@Crypto_Ed_NL) January 7, 2022

However, the market is not all gloom. Sentiment on social media remains strong, urging a strong buying trend. Bitcoin bulls tend to agree with the data that Sentiment is showing; that buying the dip is a way to take advantage of those selling Bitcoin amidst regulatory uncertainty. Several Bitcoin proponents believe that Bitcoin will see massive growth when investors in fiat are faced with inflation and that Bitcoin’s dip might be coming ahead of a major recession. Computer scientist and former Google employee Vijay Boyapati noted:

A major US recession is on the horizon. The Fed will precipitate it but then be forced to retreat when they lose control of the bursting bubble they’ve inflated for the last decade.

That is when #Bitcoin will fly.

— Vijay Boyapati (@real_vijay) January 5, 2022

Telegram revealed that many users will interface with cryptocurrency for the first time and not even notice it.

Canada is aimed at having the OECD standard for crypto asset tax reporting in place by 2027, as agreed with 46 countries.

Since the well-anticipated spot Bitcoin ETF event is over, some industry experts have turned to warning signals for the the road ahead.

Bitwise revealed that in the month after past BTC halving price saw a little movement but in the following year it saw significant gains.