Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

Earlier in November this year, Chainalysis, a blockchain-focused digital analytics company, reported that cryptocurrency adoption in Africa had accelerated a whopping more than 1200% to the previous year.

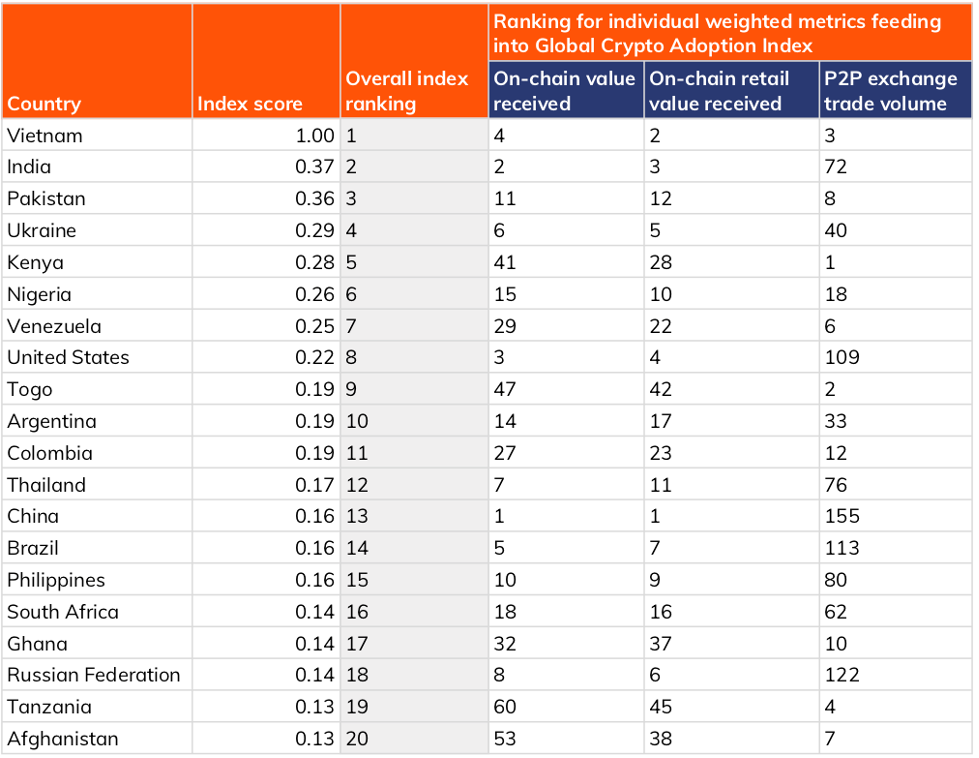

Africa is the second-largest region for peer-to-peer transaction volume globally. Four African countries, Kenya, Nigeria, South Africa, and Tanzania ranked in the top twenty of the 2021 Chainalysis Global Crypto Adoption Index.

Source: Chainalysis

African crypto adoption has surged from the middle of 2020, with an emerging crypto market increase in value. As more users look to crypto, the wealth of the digital market across the continent has exploded. Chainlaysis revealed that Africa’s crypto market has surged by $105.6 billion worth of digital assets during the past year.

The research also showed that users preferred peer-to-peer platforms like Paxful and Remitano to send crypto assets, as opposed to trading exchanges.

In 2020, Nigeria’s alone weekly P2P volumes reported $5 million USD to $10 million USD, followed by Kenya and South Africa second to Nigeria, which sees between $1 USD to $2 million traded USD weekly.

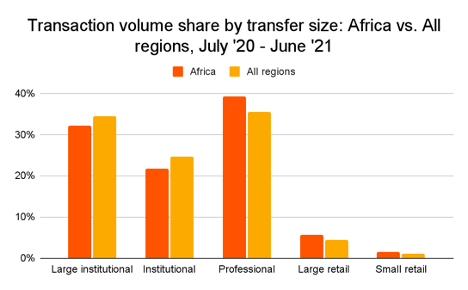

Africa’s cryptocurrency market also boasts a larger share of the entire retail transaction volume when compared to other regions. According to business insights, Africa’s retail sized transfers 7% of overall retail transfers, versus the global average of 5.5%.

So why is Africa such a hot spot for emergent cryptocurrency adoption? What is driving the digital market in the region so fiercely? There are a few factors of importance that are leading the continent to look to crypto. According to reports, there are four significant reasons for crypto trends in Africa:

Peer-to-peer trading is one of the most driving factors that lead to increased African cryptocurrency adoption. These trading platforms execute trade between parties without the intervention of banks for foreign exchanges.

Source: Chainalysis

Another reason for the increasing popularity of cryptocurrency in Africa is related to the need for an effective means to send money across borders: Remittances. A large community of African workers live away from their home town; they prefer using peer-to-peer exchanges like Paxful and Remitano to avoid the high cost of sending money through foreign exchange across the border.

Marius Reitz, GM of Luno, Africa considering the growing demand of Crypto in Remittances, told to the publication of Quartz:

“The demand for crypto is an outcome of the challenges that Africans experiences across Africa.”

In many countries, people struggle to transfer their money using bank accounts to centralised exchanges; and opting to send cryptocurrency offers a faster, safer, and cheaper method of moving funds.

Chainalysis reported the highest trend of grassroots crypto adoption. According to research, as noted above, Africans make 7% retail payments of the entire retail transfers that are higher than the global average of 5.5% Global Crypto Adoption Index highlights the highest digital assets acceptance by local inhabitants of Kenya, Nigeria, South Africa, and Tanzania, ranking in the top 20 of the Chainalysis Global Crypto Adoption Index.

Many African economies face high inflation, suffering from the constant devaluation of fiat currency, which ultimately erodes wealth and savings. Business insights revealed 8 African countries with an extreme inflation rate.

The countries staggering inflation rates are Sudan, Zimbabwe, South Sudan, Ethiopia, Angola, Zambia, Nigeria, and Sierra Leone with 387.56%, 50%, 40%, 37.6%, 29.7%, 22.1%, 17.59%, and 10.88%, respectively.

Cryptocurrency offers a way to combat growing inflation with more stability and increasing value, despite the reputation of volatility.

Economic world forum reported that Africa is the second most populous continent with 1.3 billion people globally. Still, 57% of its population don’t have a bank account. Despite being largely unbanked, Africa has massive potential to access digital financial services through smartphones or the internet. More Africans own a mobile phone with access to the internet than access to a bank account.

With cryptocurrency, there’s a massive opportunity to bank the unbanked.

African countries have the underdeveloped infrastructure and have less access to financial services. Therefore, cryptocurrency is a good alternative to traditional banking services in Africa.

Statistics of the World Bank revealed that African wealth output is 22 x less than European Union. With but $105.6 billion USD worth of cryptocurrency assets locked between July 2020 and June 2021, the continent has the largest share of peer-to-peer payment transfers in the world.

Africa is still planning to boost crypto growth with countries across the continent looking to develop better infrastructure allowing the industry to blossom. For example:

Nigeria has launched Africa’s first Digital currency, eNaira, on October 25, 2021, to accelerate economic growth in Africa.

In September 2021, South Africa announced a joint initiative with Australia, Singapore Malaysia to use prototype shared DLT platforms for the settlement of cross border transactions using Central Bank digital currencies CBDC.

DLT will allow financial institutions to transact digital currencies directly with each other using digital wallets, eliminating the need for multiple intermediaries, enabling faster and cheaper transactions.

As more countries in Africa look to cryptocurrency, we might start seeing just what a massive impact the digital currency market can have on emerging markets.

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.