Italy Considers Raising Capital Gains Tax on Bitcoin from 26% to 42%

Italy plans to increase the withholding tax on BTC capital gains to 42% eliminating 750 million euro minimum revenue threshold for the DST.

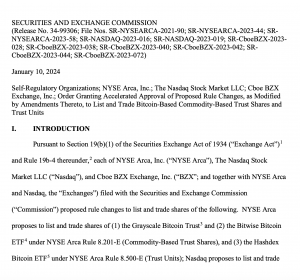

The United States and Exchange Commission has officially green lit the first regulated spot Bitcoin ETF in the country.

The regulator gave its official approval from applications from several financial exchanges. These include ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, Grayscale, Bitwise, Hashdex and Franklin Templeton. The approval will allow the exchanges to list and offer trading for a spot Bitcoin ETF.

This approval marks the first ever exchange-traded product in the country that will give investors exposure to Bitcoin. The concept of the ETF means investors can buy shares in the ETF, which is underpinned by Bitcoin’s price, without directly buying Bitcoin or buying cryptocurrency through another exchange or ATM.

“It’s really about is removing any of the last barriers that may have kept people from looking at the space, and now that they can access it, they can access it at what we think is a very attractive price point, we think that it is going to increase the number of people.”

Italy plans to increase the withholding tax on BTC capital gains to 42% eliminating 750 million euro minimum revenue threshold for the DST.

Grayscale has requested approval from the SEC to convert its $524 million crypto fund, which tracks assets like BTC and ETH into an ETF.

The Monochrome Ethereum ETF (IETH) was launched on Cboe Australia on October 15, following the introduction of a spot Bitcoin ETF in June.

Telegram's decision to establish an office in Kazakhstan aligns with the company's growing focus on regulatory compliance.