Italy’s State-Owned Bank Trials Digital Bonds on Polygon Blockchain

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

The rise in popularity of Bitcoin is not only evident in its value. As the cryptocurrency gains more traction as an alternative asset or even as a hedge, more investors are looking to Bitcoin to hold or trade for profit.

According to a survey conducted by NORC through the University of Chicago, 13% of Americans in the sample reported that they had traded Bitcoin in the past year. The survey sampled over 1,000 people in the country (adult Americans over 18) to get a representation of the trading behaviour. The survey results also found that 24% of the respondents had traded or bought stocks in the last year.

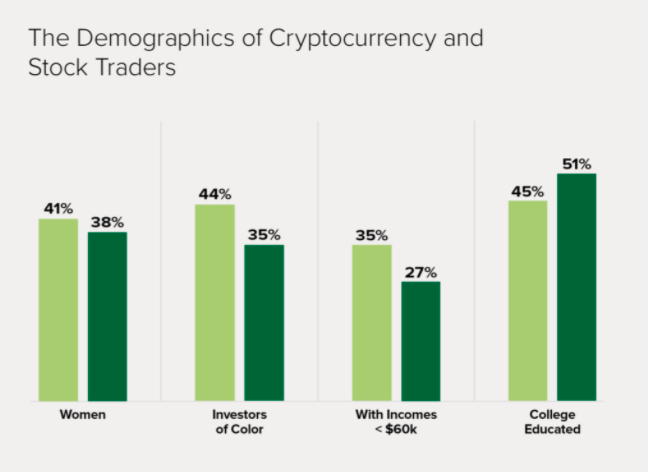

According to the results, the average age of cryptocurrency investors is around 38 years, while the average age of stock investors is 47 years. In the research, it was also found that more women are opting for cryptocurrency rather than trading stocks and those with disposable income of over $65,000 choose Bitcoin, with 35% of investors looking to cryptocurrency and 27% opting for stock trading.

Source: NORC

The research found that the major hesitation for new investors to hesitate before buying or trading Bitcoin was related to the complexity rather than the volatility. As the price of Bitcoin drove to its highest recorded value April this year, the market was flooded with new investors looking to capitalise on the growing digital currency. Even after the price of Bitcoin crashed to slice more than half, trading from $64,863.10 to $29,360.96, the market held a price nearly $10,000 more than its previous record high. According to the results of the research, only 30% of the respondents indicated concerns about volatility, while over 60% noted that they were cautious about the cryptocurrency market because they don’t understand enough. 33% indicated that they didn’t have the funds to invest in Bitcoin, 35% were concerned about the security of Bitcoin, and 31% were not sure how to invest in the market.

Source: NORC

Mark Lush, manager in the Economics, Justice, and Society department at NORC, weighed in on the results, noting that new investors might be cautious of funding long-term investment – such as retirement funds – with the asset. He stated:

“Cryptocurrency is a relatively new option for retirement funds. Potential investors are leery of investing their retirement savings into what has been, to date, a fairly volatile investment. Cryptocurrencies may have staying power as an investment option, but our hunch is that they will continue to lag behind more traditional investment opportunities for the foreseeable future.”

According to Angela Fontes, vice president of the Economics, Justice, and Society department at NORC at the University of Chicago, the shift towards cryptocurrency adoption in the country is driven by investors who are looking to diversify their portfolios. She continued to say that pertinent information about the market is important for investors to make sound decisions, noting:

“Cryptocurrencies are opening up investing opportunities for more diverse investors, which is a very good thing. It will be important that these investors have access to sound information as they make decisions related to these often more volatile investments.”

The European Central Bank initiated the trial to explore how blockchains can enhance central bank settlement.

n recent months, inflation measures, including the Consumer Price Index and Personal Consumption Expenditures Index, have moderated.

BlockFi clients are to note that client communications will exclusively occur through official email channels.

CryptoQuant CEO says Bitcoin is still vulnerable to “speculative FUDs,” giving smart money a way to buy up cheap BTC.